Question: Question 13 3 pts Decline Inc. is trying to determine its cost of debt. The firm has a debt issue outstanding with 13 years to

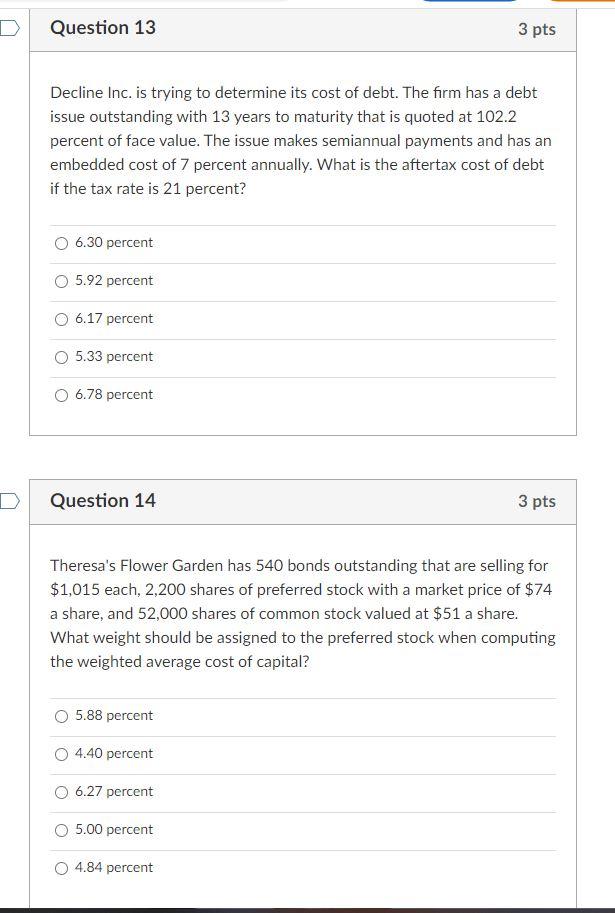

Question 13 3 pts Decline Inc. is trying to determine its cost of debt. The firm has a debt issue outstanding with 13 years to maturity that is quoted at 102.2 percent of face value. The issue makes semiannual payments and has an embedded cost of 7 percent annually. What is the aftertax cost of debt if the tax rate is 21 percent? 6.30 percent 5.92 percent 6.17 percent 5.33 percent 6.78 percent Question 14 3 pts Theresa's Flower Garden has 540 bonds outstanding that are selling for $1,015 each, 2,200 shares of preferred stock with a market price of $74 a share, and 52,000 shares of common stock valued at $51 a share. What weight should be assigned to the preferred stock when computing the weighted average cost of capital? 5.88 percent 4.40 percent O 6.27 percent O 5.00 percent 4.84 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts