Question: Question 13 (5 points) A two-year project has an initial requirement of $500,000 for fixed assets. The fixed assets will be depreciated using MACRS and

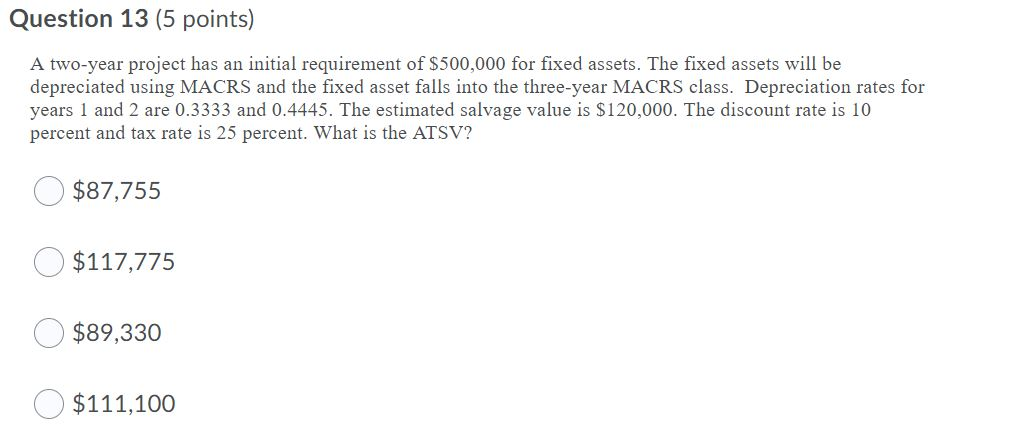

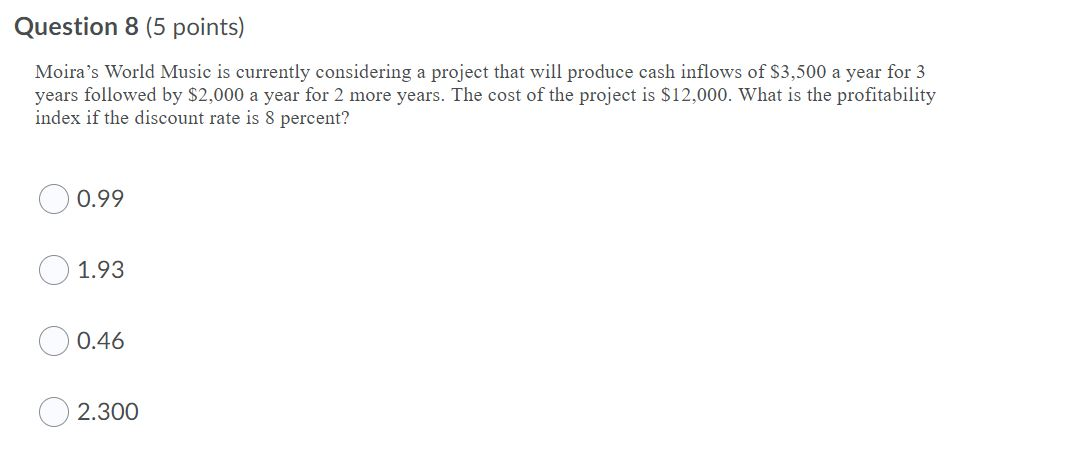

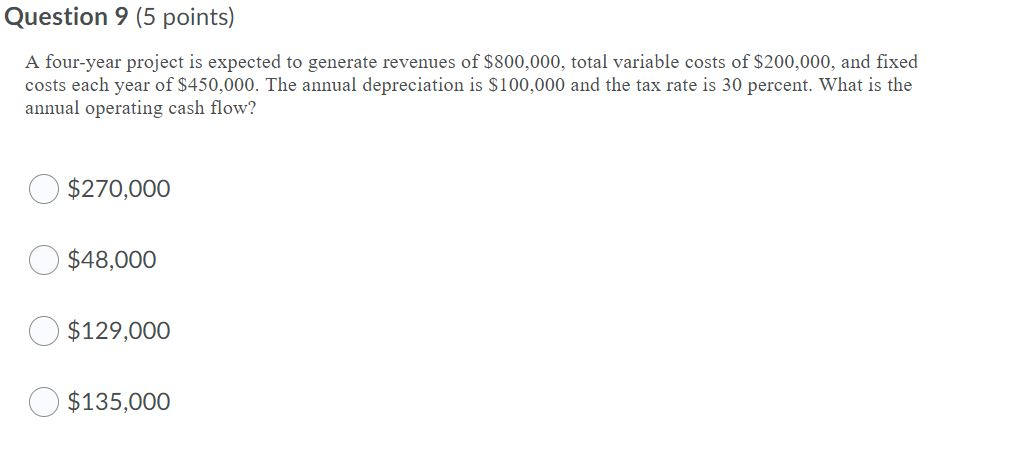

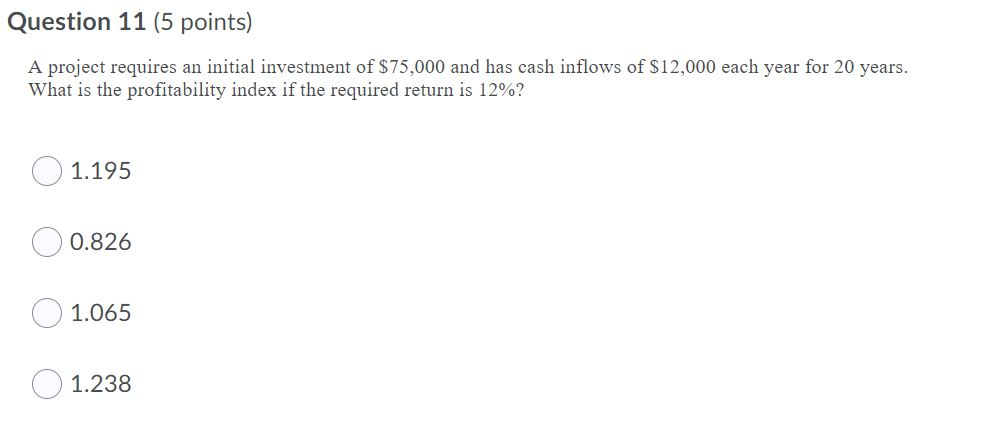

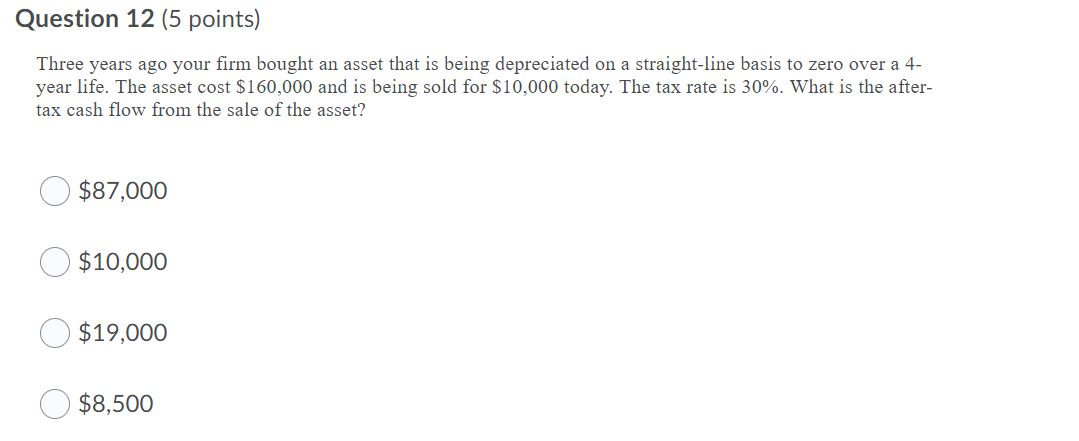

Question 13 (5 points) A two-year project has an initial requirement of $500,000 for fixed assets. The fixed assets will be depreciated using MACRS and the fixed asset falls into the three-year MACRS class. Depreciation rates for years 1 and 2 are 0.3333 and 0.4445. The estimated salvage value is $120,000. The discount rate is 10 percent and tax rate is 25 percent. What is the ATSV? $87,755 $117,775 $89,330 $111,100 Question 8 (5 points) Moira's World Music is currently considering a project that will produce cash inflows of $3,500 a year for 3 years followed by $2,000 a year for 2 more years. The cost of the project is $12,000. What is the profitability index if the discount rate is 8 percent? 0.99 1.93 0.46 2.300 Question 9 (5 points) A four-year project is expected to generate revenues of $800,000, total variable costs of $200,000, and fixed costs each year of $450,000. The annual depreciation is $100,000 and the tax rate is 30 percent. What is the annual operating cash flow? $270,000 $48,000 $129,000 $135,000 Question 11 (5 points) A project requires an initial investment of $75,000 and has cash inflows of $12,000 each year for 20 years. What is the profitability index if the required return is 12%? 1.195 0.826 1.065 1.238 Question 12 (5 points) Three years ago your firm bought an asset that is being depreciated on a straight-line basis to zero over a 4- year life. The asset cost $160,000 and is being sold for $10,000 today. The tax rate is 30%. What is the after- tax cash flow from the sale of the asset? $87,000 $10,000 $19,000 $8,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts