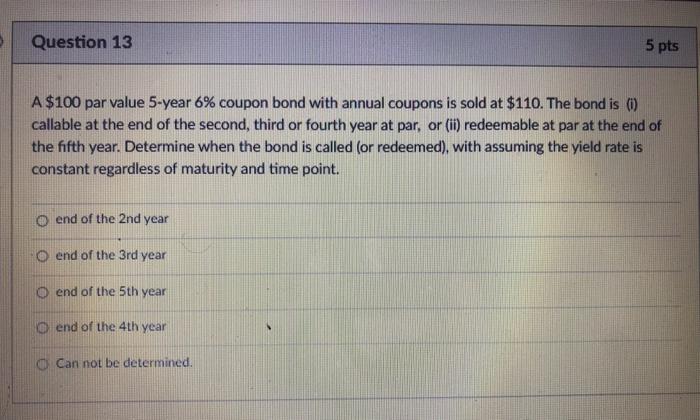

Question: Question 13 5 pts A $100 par value 5-year 6% coupon bond with annual coupons is sold at $110. The bond is callable at the

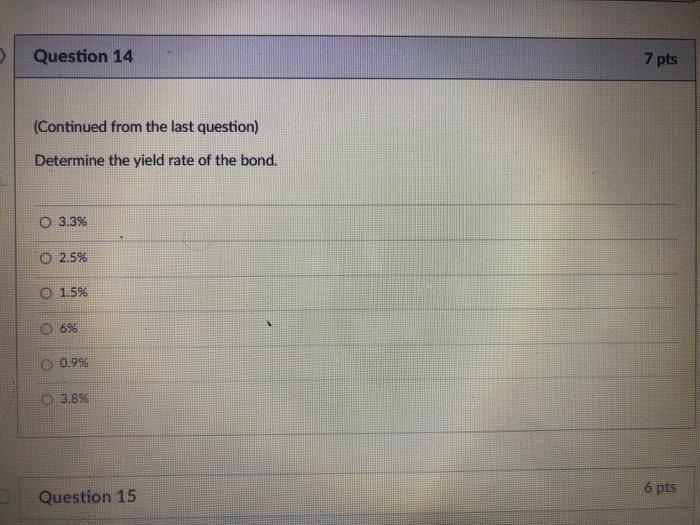

Question 13 5 pts A $100 par value 5-year 6% coupon bond with annual coupons is sold at $110. The bond is callable at the end of the second, third or fourth year at par, or (ii) redeemable at par at the end of the fifth year. Determine when the bond is called (or redeemed), with assuming the yield rate is constant regardless of maturity and time point. o end of the 2nd year O end of the 3rd year o end of the 5th year o end of the 4th year Can not be determined. 3 Question 14 7 pts (Continued from the last question) Determine the yield rate of the bond. O 3.3% 0 2.5% 0 1.5% O 0.996 0 3.89 6 pts Question 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts