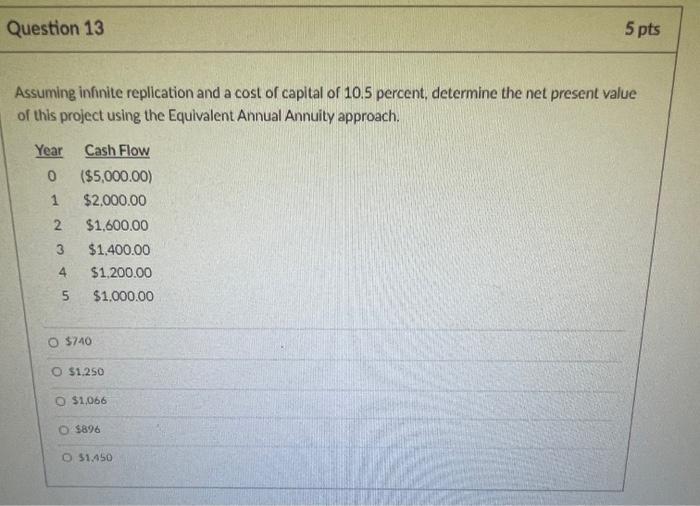

Question: Question 13 5 pts Assuming infinite replication and a cost of capital of 10.5 percent, determine the net present value of this project using the

Question 13 5 pts Assuming infinite replication and a cost of capital of 10.5 percent, determine the net present value of this project using the Equivalent Annual Annuity approach. Year 0 1 2 3 Cash Flow ($5,000.00) $2,000.00 $1,600.00 $1.400.00 $1,200.00 $1.000.00 4 5 $740 O $1.250 O $1.066 $896 O 51.450

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts