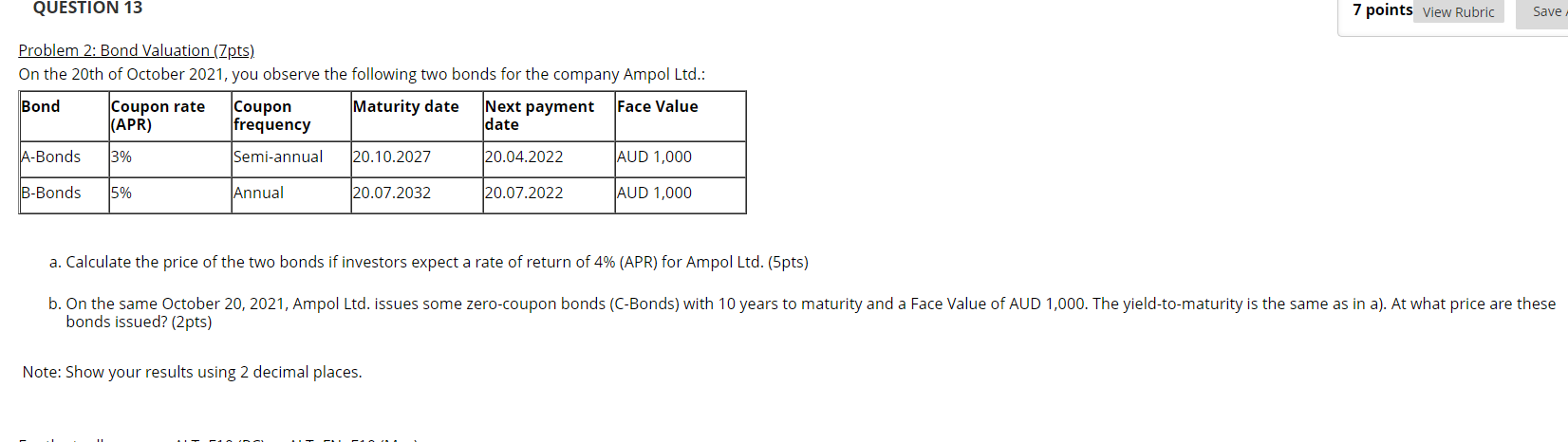

Question: QUESTION 13 7 points View Rubric Save Problem 2: Bond Valuation (Zpts) On the 20th of October 2021, you observe the following two bonds for

QUESTION 13 7 points View Rubric Save Problem 2: Bond Valuation (Zpts) On the 20th of October 2021, you observe the following two bonds for the company Ampol Ltd.: Bond Coupon rate Coupon Maturity date Next payment Face Value (APR) frequency date A-Bonds 3% Semi-annual 20.10.2027 20.04.2022 AUD 1,000 B-Bonds 15% Annual 20.07.2032 20.07.2022 AUD 1,000 a. Calculate the price of the two bonds if investors expect a rate of return of 4% (APR) for Ampol Ltd. (5pts) b. On the same October 20, 2021, Ampol Ltd. issues some zero-coupon bonds (C-Bonds) with 10 years to maturity and a Face Value of AUD 1,000. The yield-to-maturity is the same as in a). At what price are these bonds issued? (2pts) Note: Show your results using 2 decimal places. QUESTION 13 7 points View Rubric Save Problem 2: Bond Valuation (Zpts) On the 20th of October 2021, you observe the following two bonds for the company Ampol Ltd.: Bond Coupon rate Coupon Maturity date Next payment Face Value (APR) frequency date A-Bonds 3% Semi-annual 20.10.2027 20.04.2022 AUD 1,000 B-Bonds 15% Annual 20.07.2032 20.07.2022 AUD 1,000 a. Calculate the price of the two bonds if investors expect a rate of return of 4% (APR) for Ampol Ltd. (5pts) b. On the same October 20, 2021, Ampol Ltd. issues some zero-coupon bonds (C-Bonds) with 10 years to maturity and a Face Value of AUD 1,000. The yield-to-maturity is the same as in a). At what price are these bonds issued? (2pts) Note: Show your results using 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts