Question: Question 13 8 points Save Answer A 15 year bond has a par value of $1,000, a coupon rate of 8% with interest paid ANNUALLY.

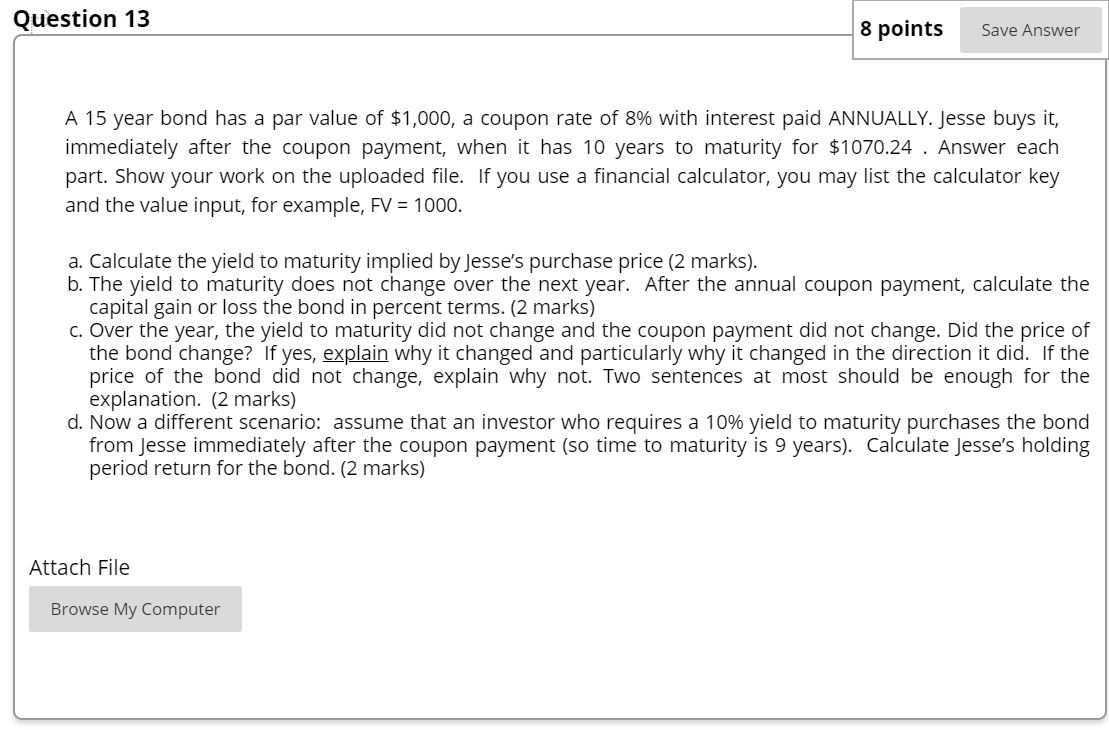

Question 13 8 points Save Answer A 15 year bond has a par value of $1,000, a coupon rate of 8% with interest paid ANNUALLY. Jesse buys it, immediately after the coupon payment, when it has 10 years to maturity for $1070.24 . Answer each part. Show your work on the uploaded file. If you use a financial calculator, you may list the calculator key and the value input, for example, FV = 1000. a. Calculate the yield to maturity implied by Jesse's purchase price (2 marks). b. The yield to maturity does not change over the next year. After the annual coupon payment, calculate the capital gain or loss the bond in percent terms. (2 marks) C. Over the year, the yield to maturity did not change and the coupon payment did not change. Did the price of the bond change? If yes, explain why it changed and particularly why it changed in the direction it did. If the price of the bond did not change, explain why not. Two sentences at most should be enough for the explanation. (2 marks) d. Now a different scenario: assume that an investor who requires a 10% yield to maturity purchases the bond from Jesse immediately after the coupon payment (so time to maturity is 9 years). Calculate Jesse's holding period return for the bond. (2 marks) Attach File Browse My Computer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts