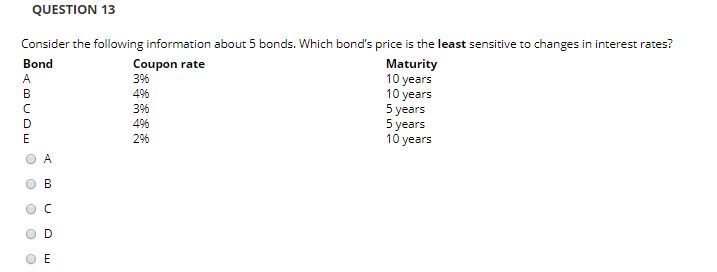

Question: QUESTION 13 Consider the following information about 5 bonds. Which bond's price is the least sensitive to changes in interest rates? Bond Coupon rate Maturity

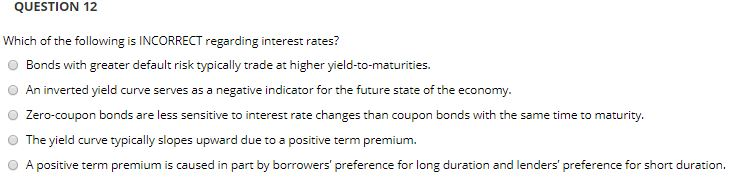

QUESTION 13 Consider the following information about 5 bonds. Which bond's price is the least sensitive to changes in interest rates? Bond Coupon rate Maturity 396 10 years 496 10 years 5 years 5 years 10 years 396 OUW OOOOO QUESTION 12 Which of the following is INCORRECT regarding interest rates? Bonds with greater default risk typically trade at higher yield-to-maturities. An inverted yield curve serves as a negative indicator for the future state of the economy. Zero-coupon bonds are less sensitive to interest rate changes than coupon bonds with the same time to maturity. The yield curve typically slopes upward due to a positive term premium A positive term premium is caused in part by borrowers' preference for long duration and lenders' preference for short duration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts