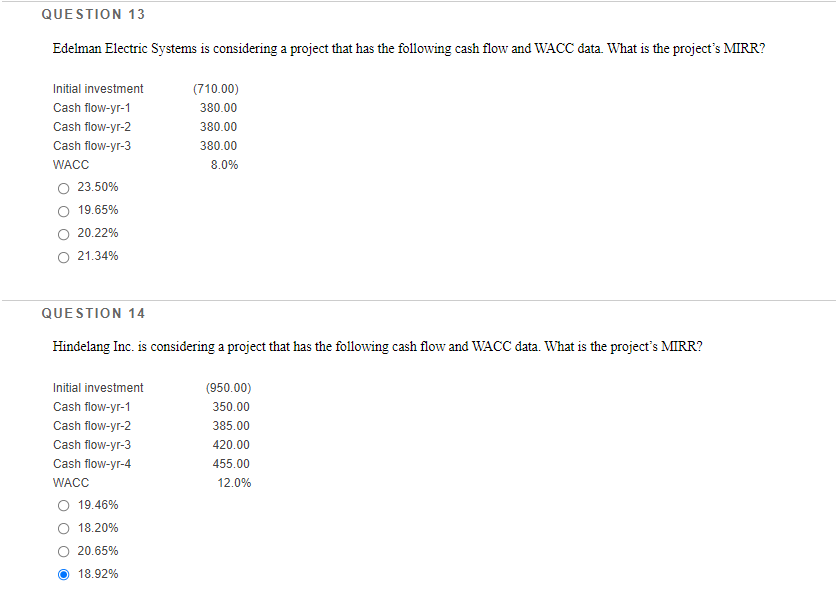

Question: QUESTION 13 Edelman Electric Systems is considering a project that has the following cash flow and WACC data. What is the project's MIRR? Initial investment

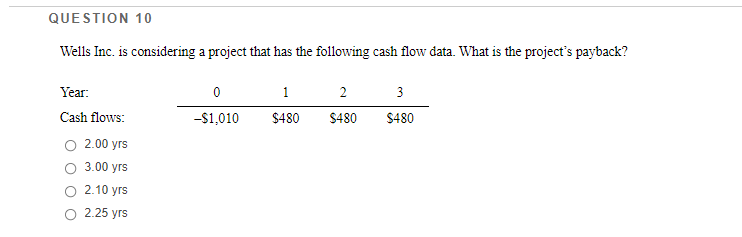

QUESTION 13 Edelman Electric Systems is considering a project that has the following cash flow and WACC data. What is the project's MIRR? Initial investment Cash flow-yr-1 Cash flow-yr-2 Cash flow-yr-3 WACC 23.50% (710.00) 380.00 380.00 380.00 8.0% 19.65% 20.22% O 21.34% QUESTION 14 Hindelang Inc. is considering a project that has the following cash flow and WACC data. What is the project's MIRR? Initial investment Cash flow-yr-1 Cash flow-yr-2 Cash flow-yr-3 Cash flow-yr-4 WACC O 19.46% 18.20% (950.00) 350.00 385.00 420.00 455.00 12.0% 20.65% O 18.92% QUESTION 10 Wells Inc. is considering a project that has the following cash flow data. What is the project's payback? 0 -$1,010 1 $480 2 $480 3 $480 Year: Cash flows: 2.00 yrs 3.00 yrs O 2.10 yrs 0 2.25 yrs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts