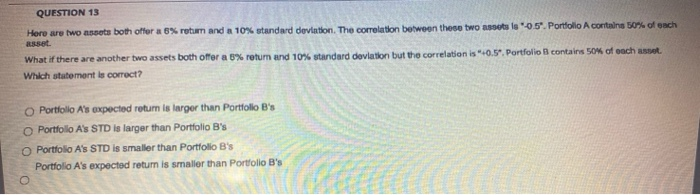

Question: QUESTION 13 Here are two assets both offer a 5% return and a 10% standard deviation. The correlation between these two assets le 0.5. Portfolio

QUESTION 13 Here are two assets both offer a 5% return and a 10% standard deviation. The correlation between these two assets le 0.5". Portfolio A containa 50% of each What if there are another two assets both offer a 5% return and 10% standard deviation but the correlation is "+0.5". Portfolio 3 contains 50m of each asset. Which statement is correct? Portfolio A's expected return is larger than Portfolio B's Portfolio A's STD is larger than Portfolio B's Portfolio A's STD is smaller than Portfolio B's Portfolio A's expected return is smaller than Portfolio B's O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts