Question: question 13 ication.com/et/maindex.html?con-condenternal throwserunch https253A%2521032fmc.meducation.co252Fghed 252F252Fimon Wind Help Save A ER Harrison received a qualified dividend. Without knowing any additional facts, which of the following

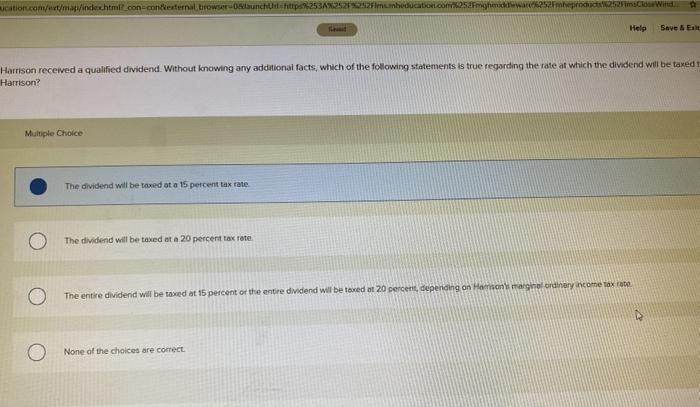

ication.com/et/maindex.html?con-condenternal throwserunch https253A%2521032fmc.meducation.co252Fghed 252F252Fimon Wind Help Save A ER Harrison received a qualified dividend. Without knowing any additional facts, which of the following statements is true regarding the rate at which the dividend will be taxedt Harrison? Multiple Choice The dividend will be taxed at a 15 percent tax rate The dividend will be taxed at a 20 percent tax rate The entire dividend will be taxed at 15 percent or the entire dividend will be taxed at 20 percent, depending on Harrison's marginal ordinary income tax inte O None of the choices are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts