Question: QUESTION 13 Martha participated in a qualified tuition program for the benefit of her son. She invested $4,000 in the fund. Four years later her

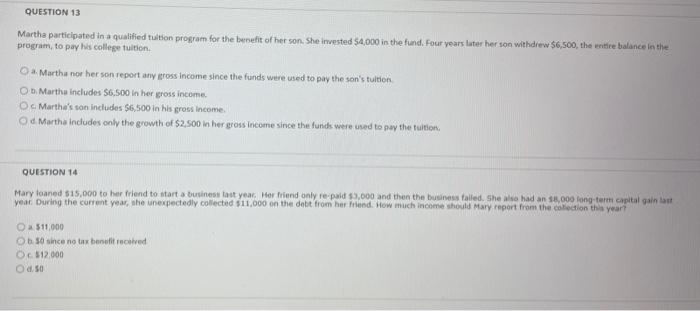

QUESTION 13 Martha participated in a qualified tuition program for the benefit of her son. She invested $4,000 in the fund. Four years later her son withdrew $6,500, the entire balance in the program, to pay his college tuition Martha nor her son report any cross Income since the funds were used to pay the son's ultion On Martha includes $6,500 in her gross income O Martha's son includes $6,500 in his gross income Od Martha Includes only the growth of $2,500 in her gross income since the funds were used to pay the tuition, QUESTION 14 Mary loaned $15,000 to her friend to start a business last year. Her friend only re-paid $5,000 and then the business failed. She also had an $8,000 long-term capital gainian year During the current year, she unexpectedly collected $11,000 on the debt from herrland. How much income should Mary report from the collection this year O a 511,000 b. 50 since no tax benefit received O $12.000 Od.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts