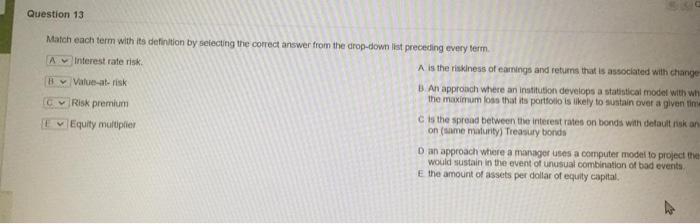

Question: Question 13 Match each term with its definition by selecting the correct answer from the drop-down list preceding every term A Interest rate risk A

Question 13 Match each term with its definition by selecting the correct answer from the drop-down list preceding every term A Interest rate risk A is the riskiness of earings and returns that is associated with change By Value at risk B An approach where an institution develops a statistical model with wh the maximum loss that its portfolio is likely to sustain over a given in Risk premium c is the spread between the interest rates on bonds with detault risk an EvEquity multiplier on (same maturity) Treasury bonds D an approach where a manager uses a computer model to project the would sustain in the event of unusual combination of bod events E the amount of assets per dollar of equity capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts