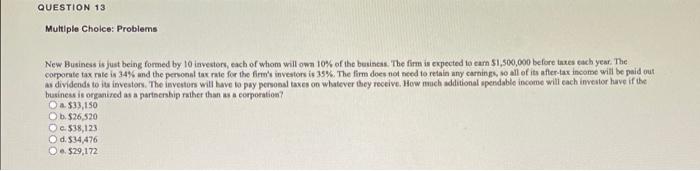

Question: QUESTION 13 Multiple Choice: Problems New Business is just being formed by investors, each of whom will own 10% of the business. The firm is

QUESTION 13 Multiple Choice: Problems New Business is just being formed by investors, each of whom will own 10% of the business. The firm is expected to earn $1,500,000 before taxes each year. The corporate tax rule is 34% and the personal tax rate for the firm's investors is 15%. The firm does not need to retain any carning to all of its after-tax income will be paid out As dividends to its investors. The investors will have to pay personal taxes on whatever they receive. How much additional pendable income will each investor have if the business is organized as a partnership rather than as a corporation? O a $33,150 Ob $26,520 Oc: 538,123 d. 334,476 O $29,172

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts