Question: Question 13 > Two investment advisers are comparing performance. One averaged a 19% rate of return and the other a 16% rate of return. However,

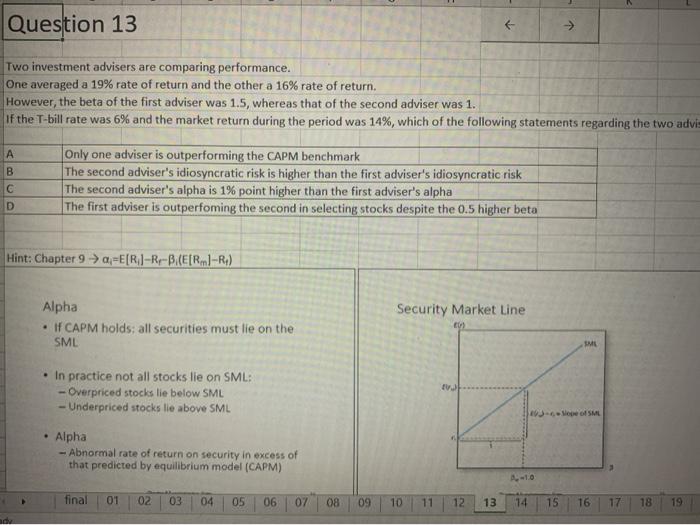

Question 13 > Two investment advisers are comparing performance. One averaged a 19% rate of return and the other a 16% rate of return. However, the beta of the first adviser was 1.5, whereas that of the second adviser was 1. If the T-bill rate was 6% and the market return during the period was 14%, which of the following statements regarding the two advi IA B Only one adviser is outperforming the CAPM benchmark The second adviser's idiosyncratic risk is higher than the first adviser's idiosyncratic risk The second adviser's alpha is 1% point higher than the first adviser's alpha The first adviser is outperfoming the second in selecting stocks despite the 0.5 higher beta D Hint: Chapter 9 a=E(R)-R-B.CE[Rm1-R) Security Market Line Alpha If CAPM holds all securities must lie on the SML ME . In practice not all stocks lie on SML: -Overpriced stocks lie below SML - Underpriced stocks lie above SML 13. Slope of SML Alpha - Abnormal rate of return on security in excess of that predicted by equilibrium model (CAPM) final 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts