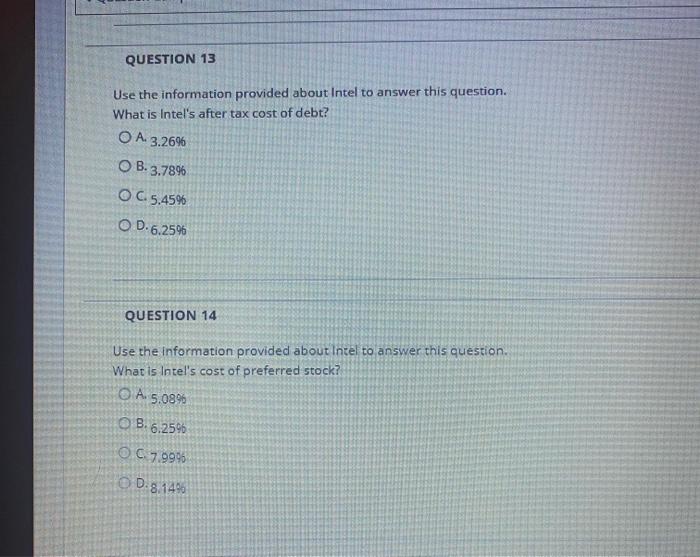

Question: QUESTION 13 Use the information provided about Intel to answer this question. What is Intel's after tax cost of debt? O A 3.26% OB.3.7896 OC.

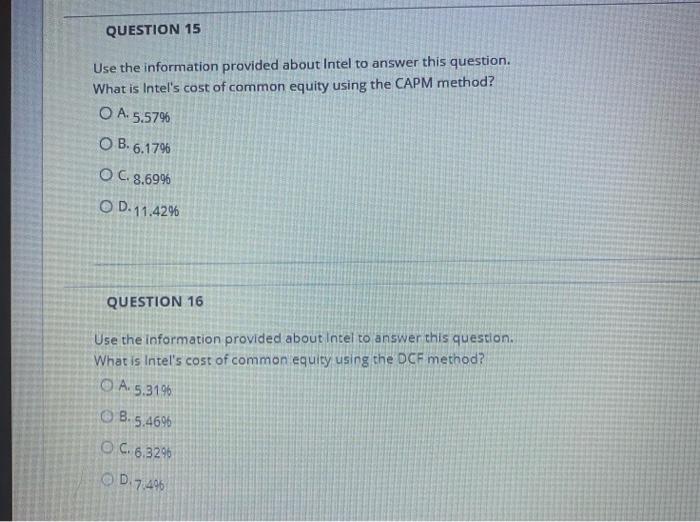

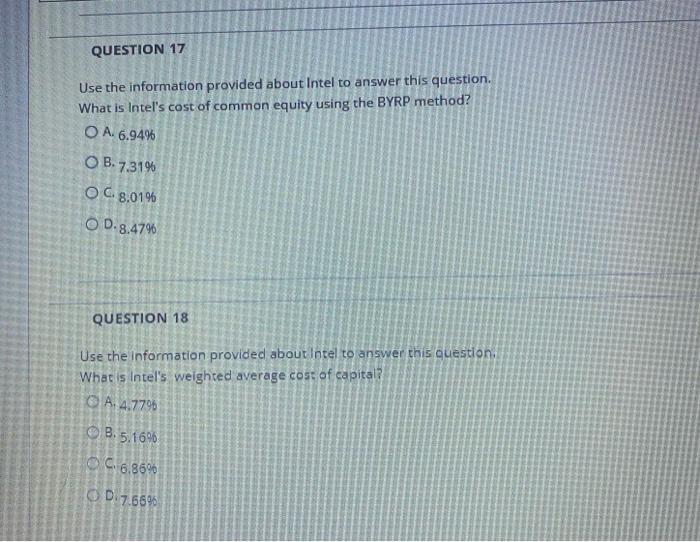

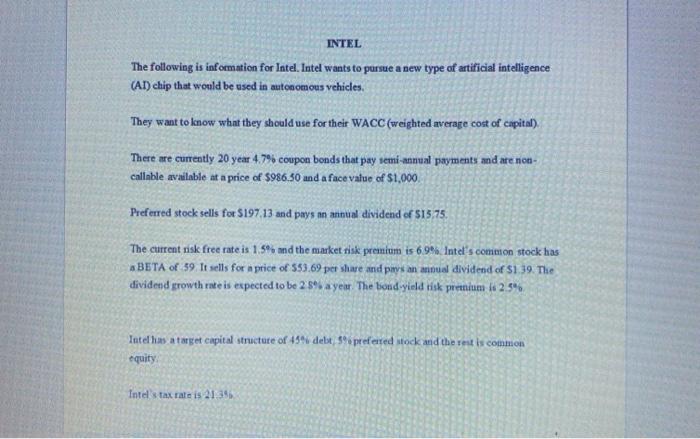

QUESTION 13 Use the information provided about Intel to answer this question. What is Intel's after tax cost of debt? O A 3.26% OB.3.7896 OC. 5.45% OD.6.25 QUESTION 14 Use the information provided about Intel to answer this question. What is Intel's cost of preferred stock? O A 5.089 OB.6.2596 O C 7.9996 OD. 8.149 QUESTION 15 Use the information provided about Intel to answer this question. What is Intel's cost of common equity using the CAPM method? O A.5.57% O B.6.1796 O C. 8.69% OD. 11.42% QUESTION 16 Use the information provided about Intel to answer this question. What is Intel's cost of common equity using the DCF method? O A.5.31% 8.5.4696 OC. 6.329 OD 7.406 QUESTION 17 Use the information provided about Intel to answer this question. What is Intel's cost of common equity using the BYRP method? O A. 6.94% OB.7.31% OC. 8.019 O D.8.47% QUESTION 18 Use the information provided about Intel to answer this question What is intel's weighted average cost of capital O A. 4.7796 8.5.16% OC. 6.86% OD.7.6696 INTEL The following is information for Intel. Intel wants to pursue a new type of artificial intelligence (AI) chip that would be used in autonomous vehicles. They want to know what they should use for their WACC (weighted average cost of capital) There are currently 20 year 4.7% coupon bonds that pay semi-annual payments and are non- callable available at a price of $986.30 and a face value of $1.000. Preferred stock sells for $197.13 and pays on minua dividend of 515,75, The current risk free rate is 1.5% and the market risk premium is 6.9% Intel's common stock has BETA of 39 It sells for a price of 553.69 per share and pt an mual dividend of $1.39. The dividend growth rate is expected to be 28% a you. The bond yield tisk pretium i 25 Intel was atorget capital structure of 45% debe 5% preferred Hock and the rest is common equity Intel's tax rate is 21.35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts