Question: QUESTION 13 Werqo Corp is considering two mutually exclusive projects, Projects A and B, and has determined that the crossover rate for these projects is

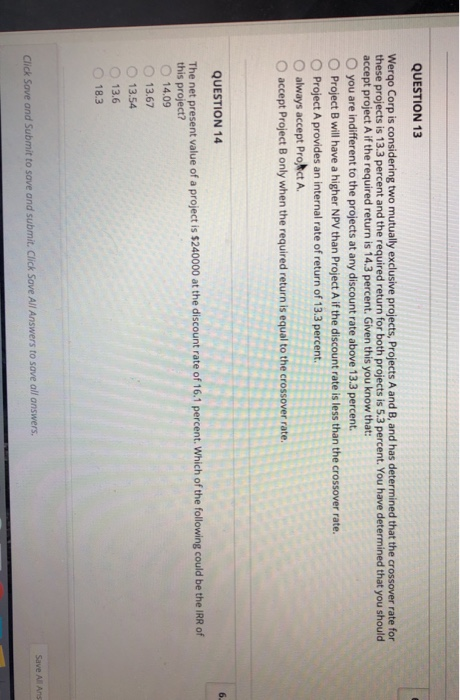

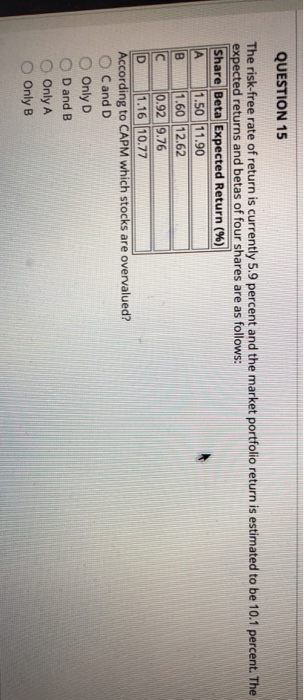

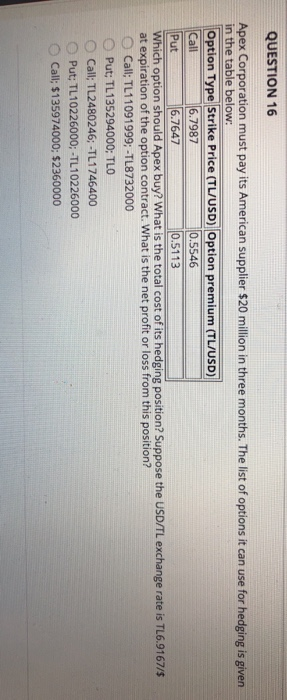

QUESTION 13 Werqo Corp is considering two mutually exclusive projects, Projects A and B, and has determined that the crossover rate for these projects is 13.3 percent and the required return for both projects is 5.3 percent. You have determined that you should accept project A if the required return is 14.3 percent. Given this you know that: O you are indifferent to the projects at any discount rate above 13.3 percent Project B will have a higher NPV than Project A if the discount rate is less than the crossover rate. Project A provides an internal rate of return of 13.3 percent always accept Proct A. accept Project B only when the required return is equal to the crossover rate. 6 QUESTION 14 The net present value of a project is $240000 at the discount rate of 16.1 percent. Which of the following could be the IRR of this project? 14.09 13.67 13.54 13.6 18.3 Save A Ans Click Save and Submit to save and submit. Click Save All Answers to save all answers, QUESTION 15 The risk-free rate of return is currently 5.9 percent and the market portfolio return is estimated to be 10.1 percent. The expected returns and betas of four shares are as follows: Share Beta Expected Return (%) 1.50 11.90 B 1.60 12.62 IC 0.92 9.76 D 1.16 10.77 According to CAPM which stocks are overvalued? C and D Only D D and B Only A Only B QUESTION 16 Apex Corporation must pay its American supplier $20 million in three months. The list of options it can use for hedging is given in the table below: Option Type Strike Price (TL/USD) Option premium (TL/USD) Call 6.7987 0.5546 Put 6.7647 0.5113 Which option should Apex buy? What is the total cost of its hedging position? Suppose the USD/TL exchange rate is 1L6.9167/$ at expiration of the option contract. What is the net profit or loss from this position? Call; TL11091999; -TL8732000 Put; TL135294000; TLO Call; TL2480246; -TL1746400 Put; TL10226000; -TL10226000 Call: $135974000: $2360000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts