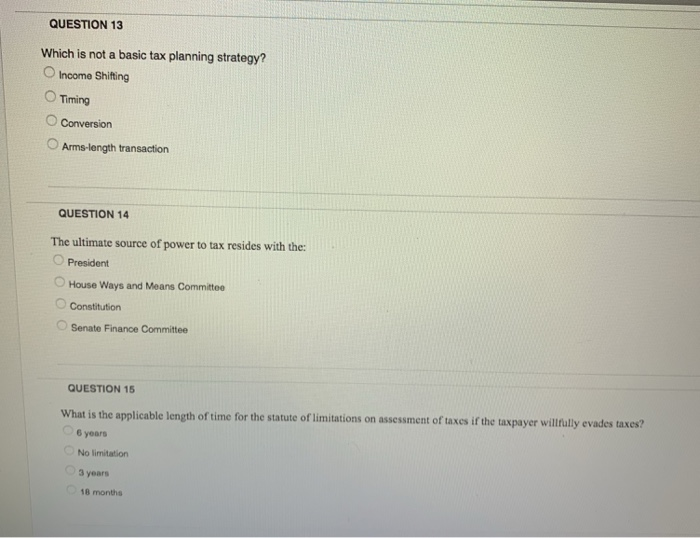

Question: QUESTION 13 Which is not a basic tax planning strategy? 0 Income Shifting O Timing O Conversion O Arms-length transaction QUESTION 14 The ultimate source

QUESTION 13 Which is not a basic tax planning strategy? 0 Income Shifting O Timing O Conversion O Arms-length transaction QUESTION 14 The ultimate source of power to tax resides with the: O President Hase Ways and Means Committee Constitution Senate Finance Committee QUESTION 15 What is the applicable length of time for the statute of limitations on assessment of taxes if the taxpayer willfully evades 6 years No limitation 3 years 18 months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts