Question: Question 14 (1 point) Based on the information below for Benson Corporation, what is the optimal capital structure? Debt = 20%; Equity = 80%; WACC

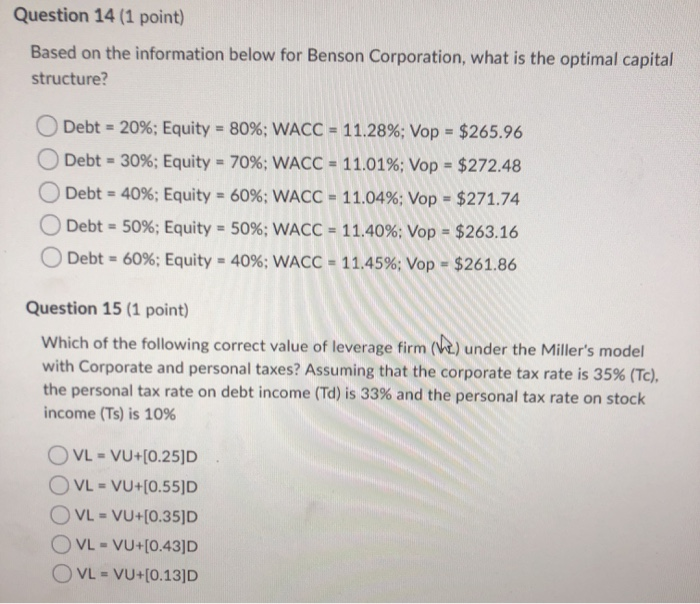

Question 14 (1 point) Based on the information below for Benson Corporation, what is the optimal capital structure? Debt = 20%; Equity = 80%; WACC = 11.28%; Vop - $265.96 Debt = 30%; Equity = 70%; WACC = 11.01%; Vop = $272.48 Debt = 40%; Equity = 60%; WACC = 11.04%; Vop = $271.74 Debt = 50%; Equity - 50%; WACC - 11.40%: Vop - $263.16 Debt = 60%; Equity - 40%; WACC - 11.45%; Vop - $261.86 Question 15 (1 point) Which of the following correct value of leverage firm (he) under the Miller's model with Corporate and personal taxes? Assuming that the corporate tax rate is 35% (TC), the personal tax rate on debt income (Td) is 33% and the personal tax rate on stock income (Ts) is 10% OVL - VU+[0.25]D OVL = VU+[0.55]D OVL = VU+[0.35]D OVL - VU+(0.43]D OVL = VU+[0.13]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts