Question: Question 14 (1 point) How many units should Wilson's Sailing Co. sell to financially break-even, given the information below on a new prospective project? Initial

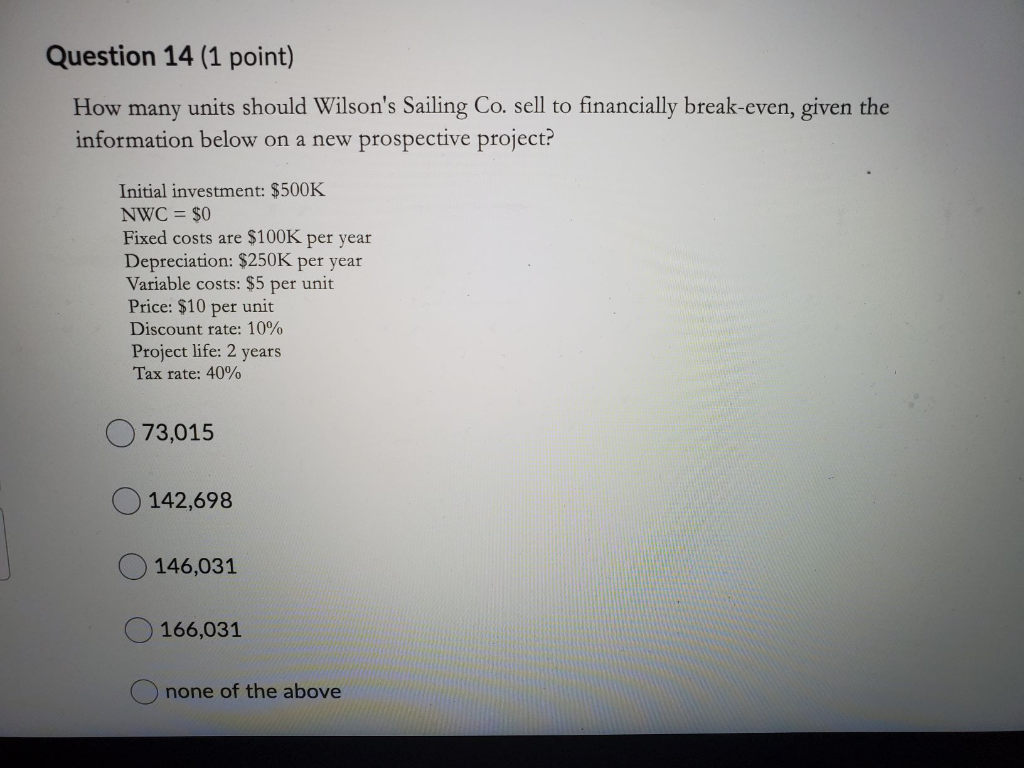

Question 14 (1 point) How many units should Wilson's Sailing Co. sell to financially break-even, given the information below on a new prospective project? Initial investment: $500K NWC = $0 Fixed costs are $100K per year Depreciation: $250K per year Variable costs: $5 per unit Price: $10 per unit Discount rate: 10% Project life: 2 years Tax rate: 40% 073,015 142,698 146,031 166,031 none of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock