Question: Question 14 (1 point) Saved Given: Portfolio A has 30% in stock X and 70% in stock Y and the correlation between stocks X and

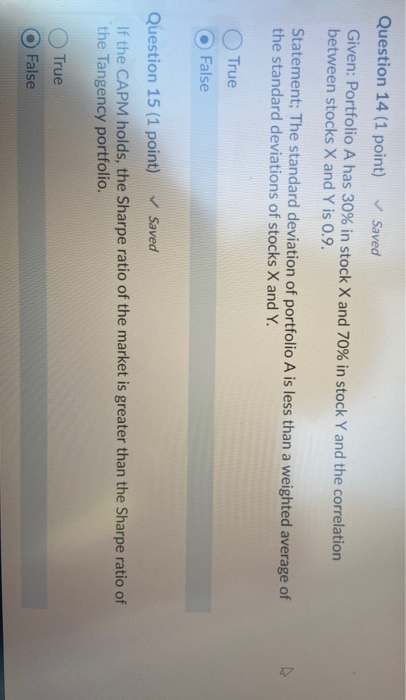

Question 14 (1 point) Saved Given: Portfolio A has 30% in stock X and 70% in stock Y and the correlation between stocks X and Y is 0.9. Statement; The standard deviation of portfolio A is less than a weighted average of the standard deviations of stocks X and Y. True False Question 15 (1 point) Saved If the CAPM holds, the Sharpe ratio of the market is greater than the Sharpe ratio of the Tangency portfolio. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts