Question: Question 14 1 pts A company is analyzing two mutually exclusive projects, S and L, whose cash flows are shown below: Years 0 1 2

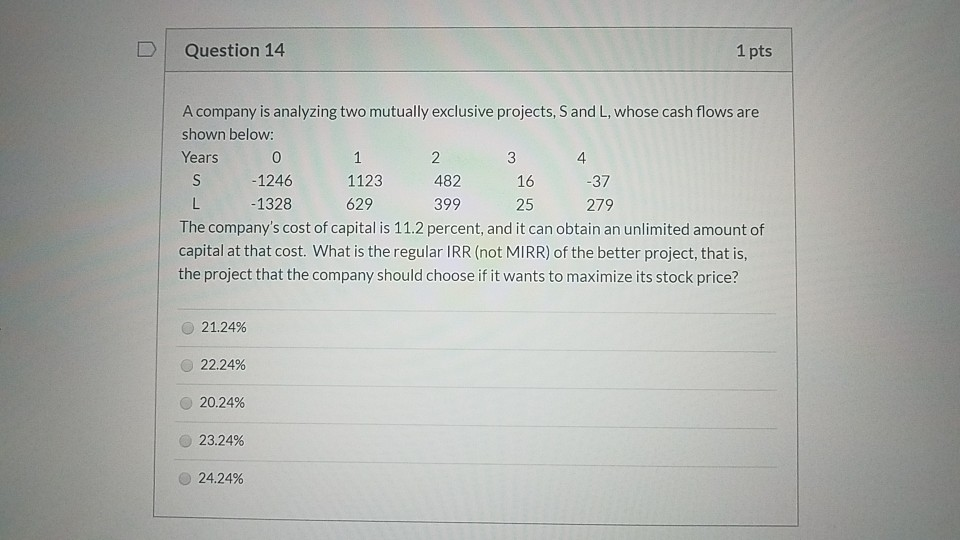

Question 14 1 pts A company is analyzing two mutually exclusive projects, S and L, whose cash flows are shown below: Years 0 1 2 3 4 S - 1246 1123 482 16 -37 -1328 629 399 25 279 The company's cost of capital is 11.2 percent, and it can obtain an unlimited amount of capital at that cost. What is the regular IRR (not MIRR) of the better project, that is, the project that the company should choose if it wants to maximize its stock price? 21.24% 22.24% 20.24% 23.24% 24.24%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts