Question: QUESTION 14 2 points S Customer Smith owed Stone Electronics $425. On April 27, 2019, Stone determined the account receivable to be uncollectible and wrote

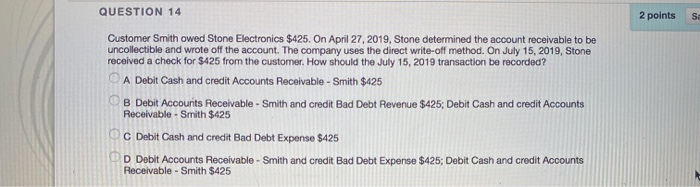

QUESTION 14 2 points S Customer Smith owed Stone Electronics $425. On April 27, 2019, Stone determined the account receivable to be uncollectible and wrote off the account. The company uses the direct write-off method. On July 15, 2019, Stone received a check for $425 from the customer. How should the July 15, 2019 transaction be recorded? A Debit Cash and credit Accounts Receivable - Smith $425 B Debit Accounts Receivable - Smith and credit Bad Debt Revenue $425; Debit Cash and credit Accounts Receivable - Smith $425 C Debit Cash and credit Bad Debt Expense $425 D Debit Accounts Receivable - Smith and credit Bad Debt Expense $425; Debit Cash and credit Accounts Receivable - Smith $425

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts