Question: Question 14 (2.5 points) There are three types of risks that affect bond yields. Among those, price risk and reinvestment risk 1) offset one another

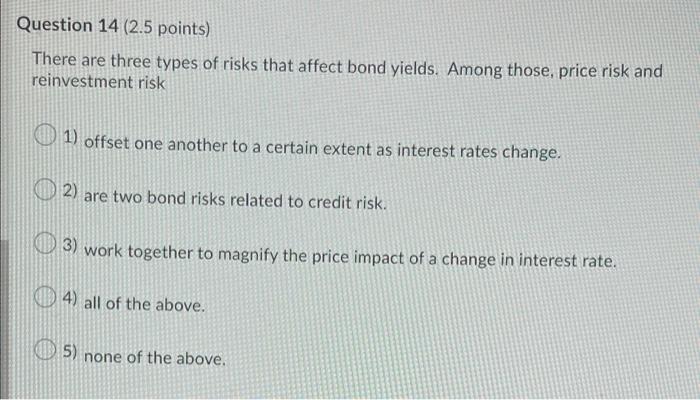

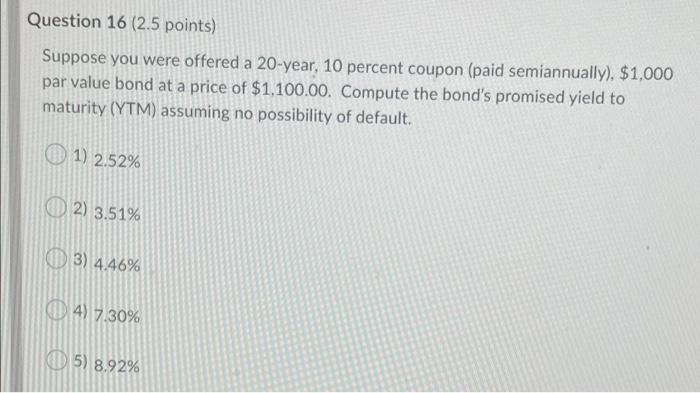

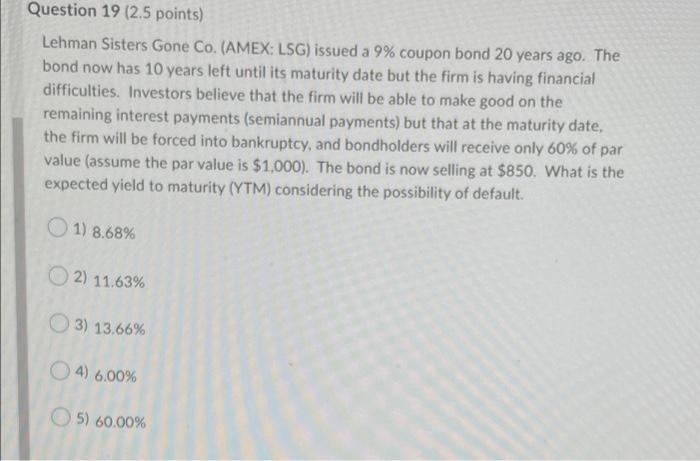

Question 14 (2.5 points) There are three types of risks that affect bond yields. Among those, price risk and reinvestment risk 1) offset one another to a certain extent as interest rates change. 2) are two bond risks related to credit risk. 3) work together to magnify the price impact of a change in interest rate. 4) all of the above. 5) none of the above. Question 16 (2.5 points) Suppose you were offered a 20-year, 10 percent coupon (paid semiannually), $1,000 par value bond at a price of $1,100.00. Compute the bond's promised yield to maturity (YTM) assuming no possibility of default. 1) 2.52% D2) 3.51% (3) 4.46% 4) 7.30% 5) 8.92% Question 19 (2.5 points) Lehman Sisters Gone Co. (AMEX: LSG) issued a 9% coupon bond 20 years ago. The bond now has 10 years left until its maturity date but the firm is having financial difficulties. Investors believe that the firm will be able to make good on the remaining interest payments (semiannual payments) but that at the maturity date, the firm will be forced into bankruptcy, and bondholders will receive only 60% of par value (assume the par value is $1,000). The bond is now selling at $850. What is the expected yield to maturity (YTM) considering the possibility of default. 1) 8.68% O2) 11.63% 3) 13.66% 4) 6.00% 5) 60.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts