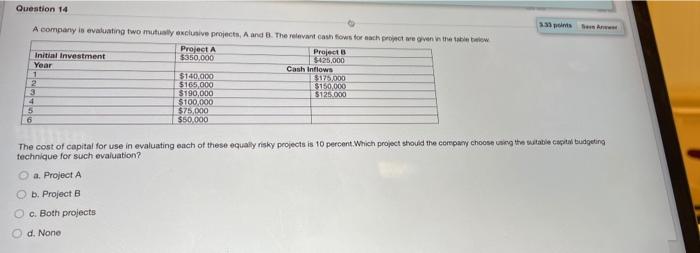

Question: Question 14 333 A company is evaluating two mutually exclusive projects, A and B The relevant cash flows for each project we given in the

Question 14 333 A company is evaluating two mutually exclusive projects, A and B The relevant cash flows for each project we given in the Project A Project Initial Investment $350,000 $425,000 Year Cash Inflows 1 $140,000 $175.000 2 5165,000 $150,000 $190,000 $125.000 4 $100,000 5 $75,000 6 550.000 The cost of capital for use in evaluating each of these equally risky projects is 10 percent. Which project should the company choosing the table capital budgeting technique for such evaluation? a. Project A b. Project B c. Both projects d. None

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts