Question: Question 14 (4 points) Based on class discussion, what is (are) the potential reason(s) for the high leverage taken by investment banks in the build

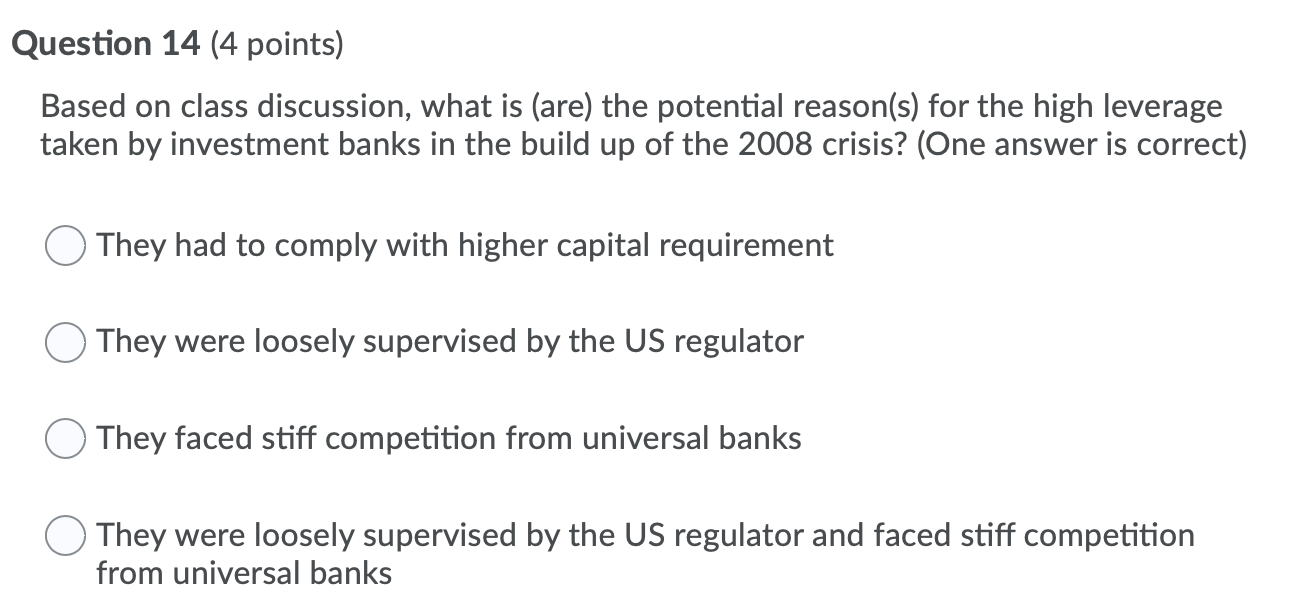

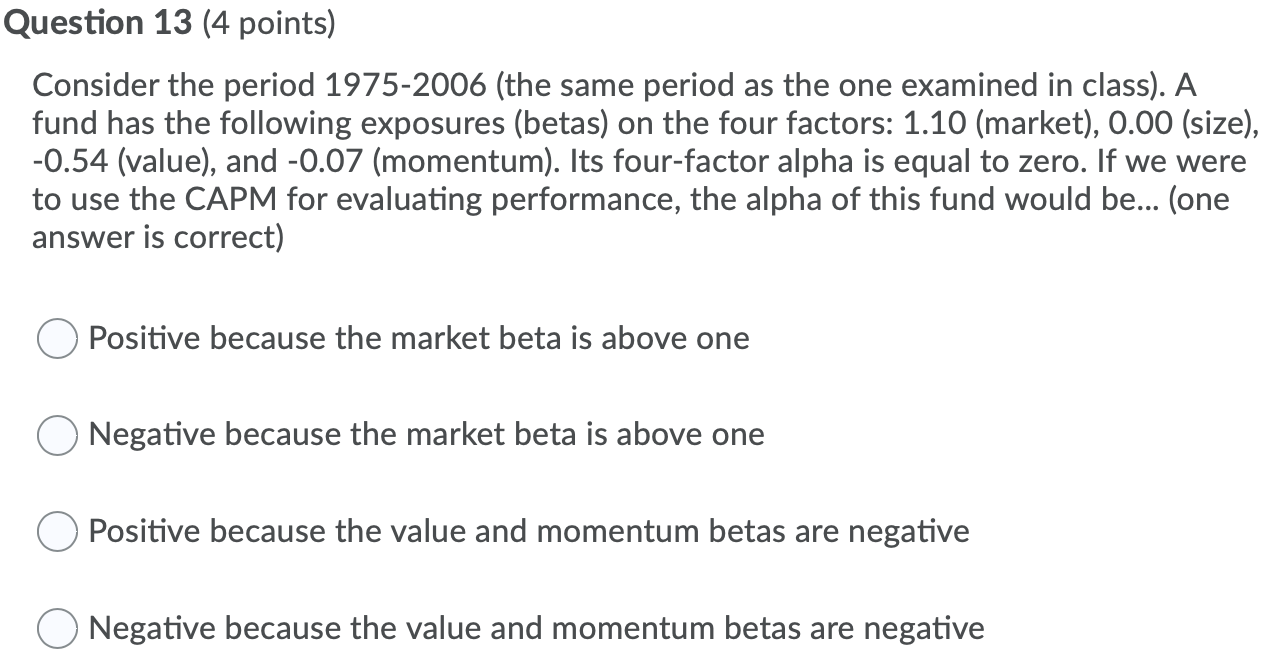

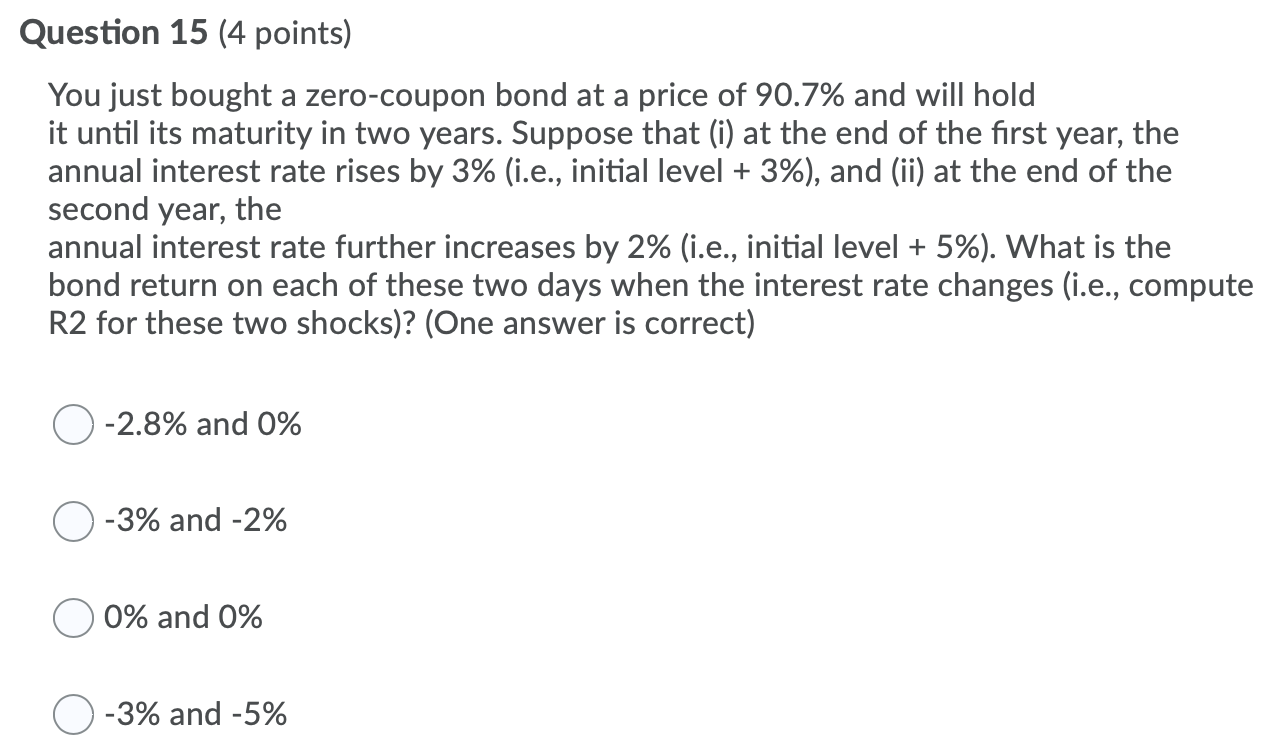

Question 14 (4 points) Based on class discussion, what is (are) the potential reason(s) for the high leverage taken by investment banks in the build up of the 2008 crisis? (One answer is correct) They had to comply with higher capital requirement They were loosely supervised by the US regulator They faced stiff competition from universal banks They were loosely supervised by the US regulator and faced stiff competition from universal banks Question 13 (4 points) Consider the period 1975-2006 (the same period as the one examined in class). A fund has the following exposures (betas) on the four factors: 1.10 (market), 0.00 (size), -0.54 (value), and -0.07 (momentum). Its four-factor alpha is equal to zero. If we were to use the CAPM for evaluating performance, the alpha of this fund would be... (one answer is correct) Positive because the market beta is above one O Negative because the market beta is above one Positive because the value and momentum betas are negative Negative because the value and momentum betas are negative Question 15 (4 points) You just bought a zero-coupon bond at a price of 90.7% and will hold it until its maturity in two years. Suppose that (i) at the end of the first year, the annual interest rate rises by 3% (i.e., initial level + 3%), and (ii) at the end of the second year, the annual interest rate further increases by 2% (i.e., initial level + 5%). What is the bond return on each of these two days when the interest rate changes (i.e., compute R2 for these two shocks)? (One answer is correct) -2.8% and 0% O-3% and -2% 0% and 0% O-3% and -5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts