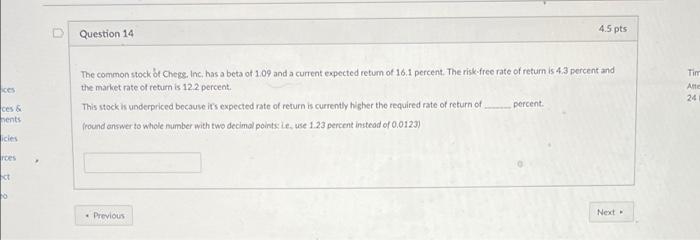

Question: Question 14 45 pts Tim te 24 The common stock or Chegg, Inc, has a beta of 1.09 and a current expected return of 16.1

Question 14 45 pts Tim te 24 The common stock or Chegg, Inc, has a beta of 1.09 and a current expected return of 16.1 percent. The risk-free rate of return is 4.3 percent and the market rate of return is 12.2 percent This stock is underpriced because it's expected rate of return is currently higher the required rate of return of percent (round answer to whole number with two decimal points to use 1.23 percent instead of 0.0123) ces & hents licies rces Next Previous

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock