Question: Question 14 (5 points) You are given the following data on US Treasury. The maturity date is May 15, 2041. The asked yield-to-maturity is 2.128%.

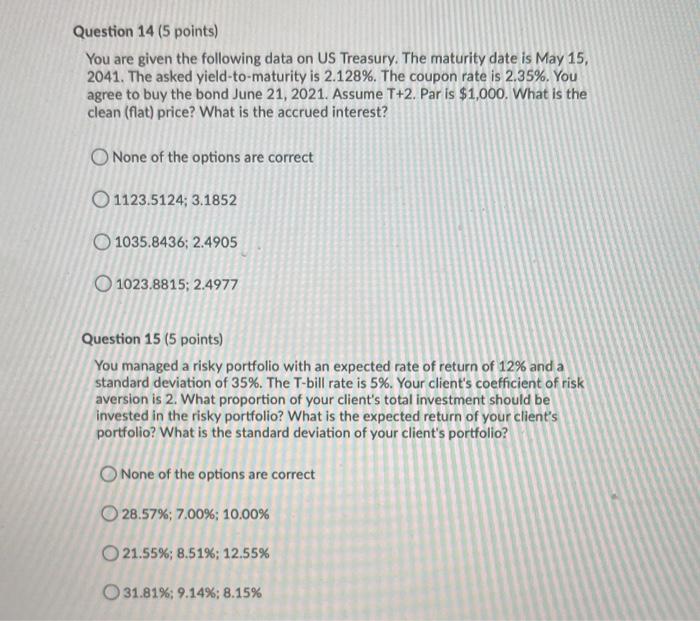

Question 14 (5 points) You are given the following data on US Treasury. The maturity date is May 15, 2041. The asked yield-to-maturity is 2.128%. The coupon rate is 2.35%. You agree to buy the bond June 21, 2021. Assume T+2. Par is $1,000. What is the clean (flat) price? What is the accrued interest? None of the options are correct 0 1123.5124; 3.1852 O 1035.8436; 2.4905 1023.8815: 2.4977 Question 15 (5 points) You managed a risky portfolio with an expected rate of return of 12% and a standard deviation of 35%. The T-bill rate is 5%. Your client's coefficient of risk aversion is 2. What proportion of your client's total investment should be invested in the risky portfolio? What is the expected return of your client's portfolio? What is the standard deviation of your client's portfolio? None of the options are correct O 28.57%; 7.00%: 10.00% 21.55%; 8.51%; 12.55% 31.81%: 9.14%; 8.15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts