Question: Question 14 5 pts Consider now at time t a portfolio II that holds one long European call option, one short European put option, a

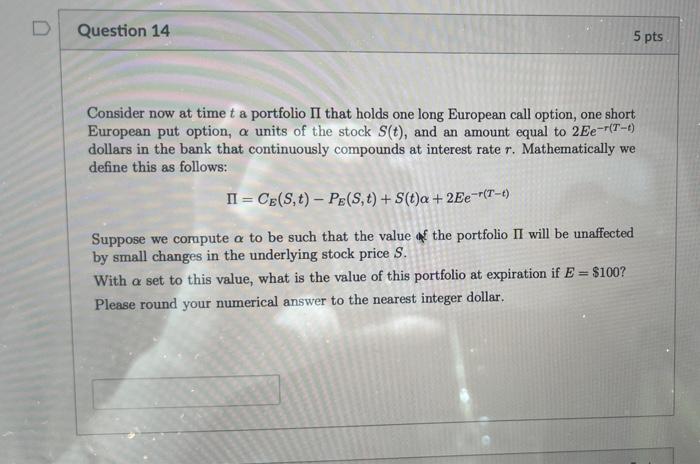

Question 14 5 pts Consider now at time t a portfolio II that holds one long European call option, one short European put option, a units of the stock S(t), and an amount equal to 2Ee--(T-1) dollars in the bank that continuously compounds at interest rate r. Mathematically we define this as follows: II = CE(S,t) - Pe(s, t) + S(t)a +2Eer(T-1) Suppose we compute a to be such that the value of the portfolio II will be unaffected by small changes in the underlying stock price S. With a set to this value, what is the value of this portfolio at expiration if E = $100? Please round your numerical answer to the nearest integer dollar

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock