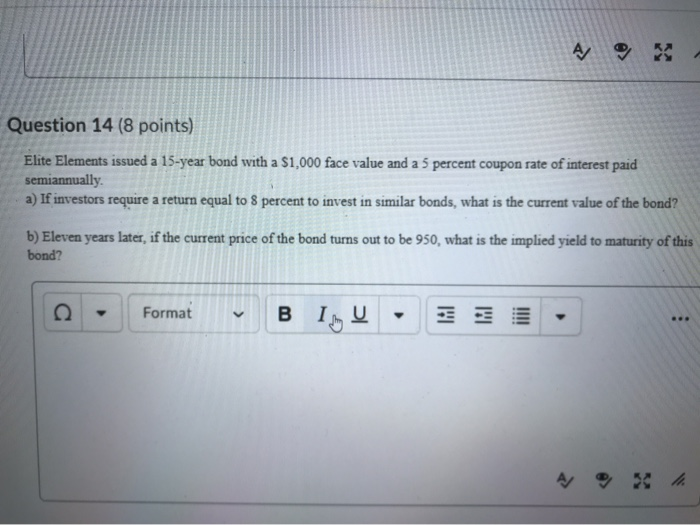

Question: Question 14 (8 points) Elite Elements issued a 15-year bond with a $1,000 face value and a 5 percent coupon rate of interest paid semiannually

Question 14 (8 points) Elite Elements issued a 15-year bond with a $1,000 face value and a 5 percent coupon rate of interest paid semiannually a) If investors require a return equal to 8 percent to invest in similar bonds, what is the current value of the bond? b) Eleven years later, if the current price of the bond turns out to be 950, what is the implied yield to maturity of this bond? - Format B I, U , 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts