Question: Question 14 (8 points) Saved Castle Inc. purchased a machine on January 1, 2019 at a cost of $12,000. The machine is estimated to have

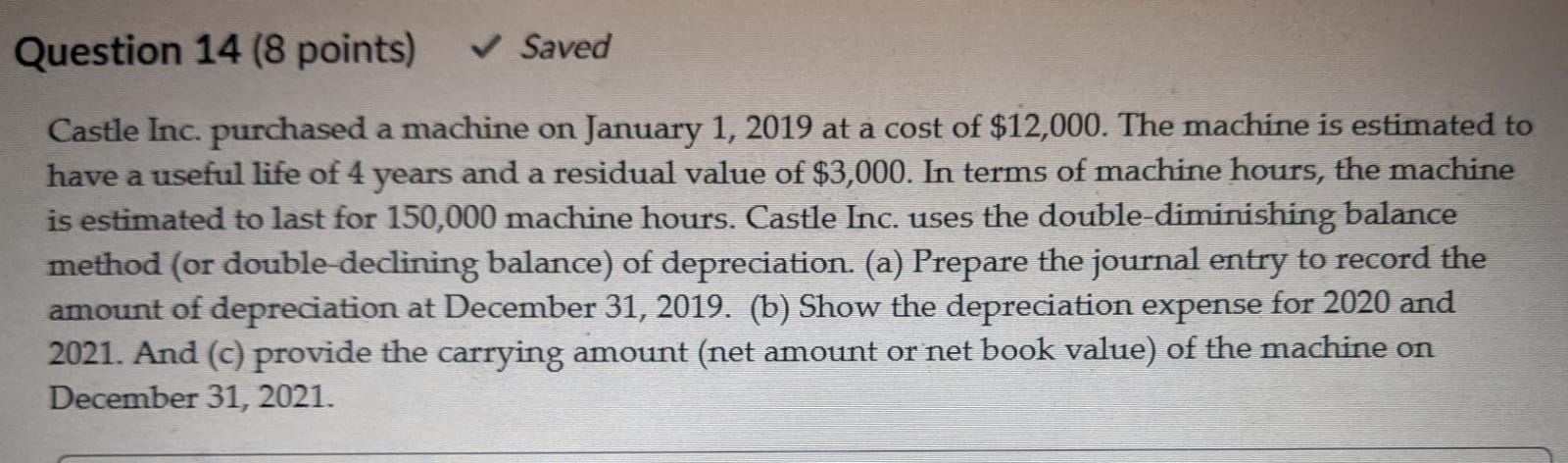

Question 14 (8 points) Saved Castle Inc. purchased a machine on January 1, 2019 at a cost of $12,000. The machine is estimated to have a useful life of 4 years and a residual value of $3,000. In terms of machine hours, the machine is estimated to last for 150,000 machine hours. Castle Inc. uses the double-diminishing balance method (or double-declining balance) of depreciation. (a) Prepare the journal entry to record the amount of depreciation at December 31, 2019. (b) Show the depreciation expense for 2020 and 2021. And (C) provide the carrying amount (net amount or net book value) of the machine on December 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts