Question: QUESTION 14 Chip Co. leared a machine to Dads Co. Assume the lease payments were made on the basis that the residual value was guaranteed

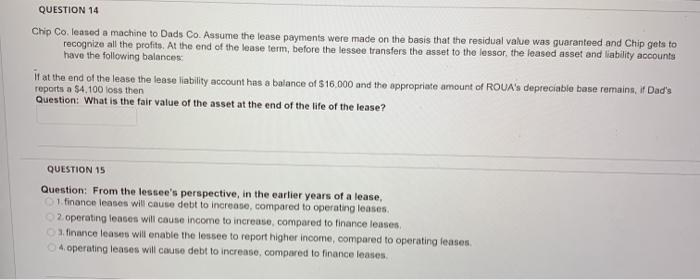

QUESTION 14 Chip Co. leared a machine to Dads Co. Assume the lease payments were made on the basis that the residual value was guaranteed and Chip gets to recognize all the profits. At the end of the lease term, before the lessee transfers the asset to the lessor, the leased asset and liability accounts have the following balances it at the end of the lease the lease liability account has a balance of $16.000 and the appropriate amount of ROUA's depreciable base remains, it Dad's reports a $4.100 loss then Question: What is the fair value of the asset at the end of the life of the lease? QUESTION 15 Question: From the lessee's perspective, in the earlier years of a lease, 1. finance leases will cause debt to increase, compared to operating leases. 2 operating leases will cause income to increase, compared to finance leases finance leases will enable the lessee to report higher income, compared to operating feases. 4 operating leases will couse debt to increase, compared to finance leases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts