Question: question 14 help please MACRS Depreciation Table Table 7-2. 150% Declining Balance Method (Half-Year Convention) Year 3-Year 5-Year 7-Year 20-Year 25.0% 15.00% 10.71% 3.750% 2

question 14 help please

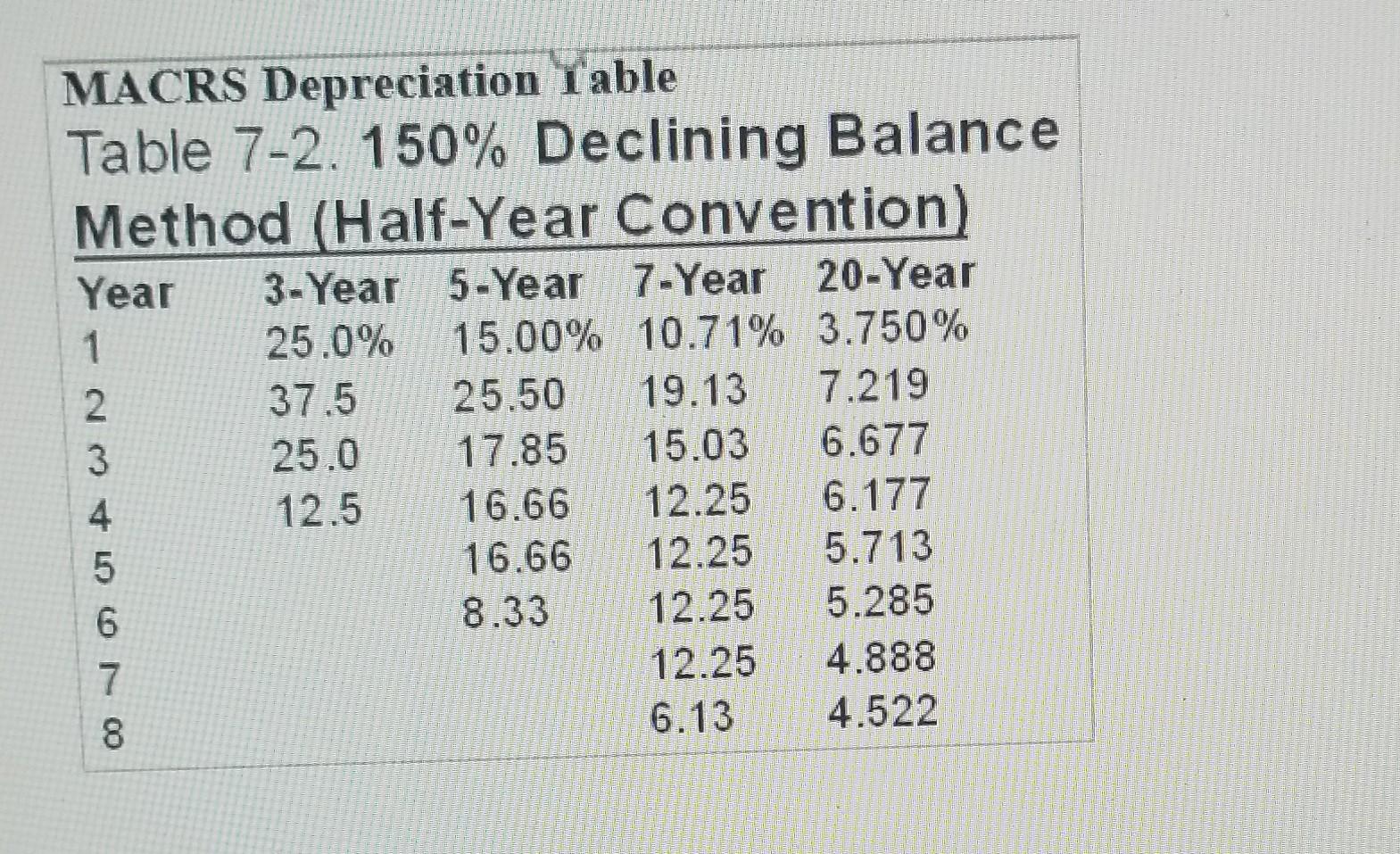

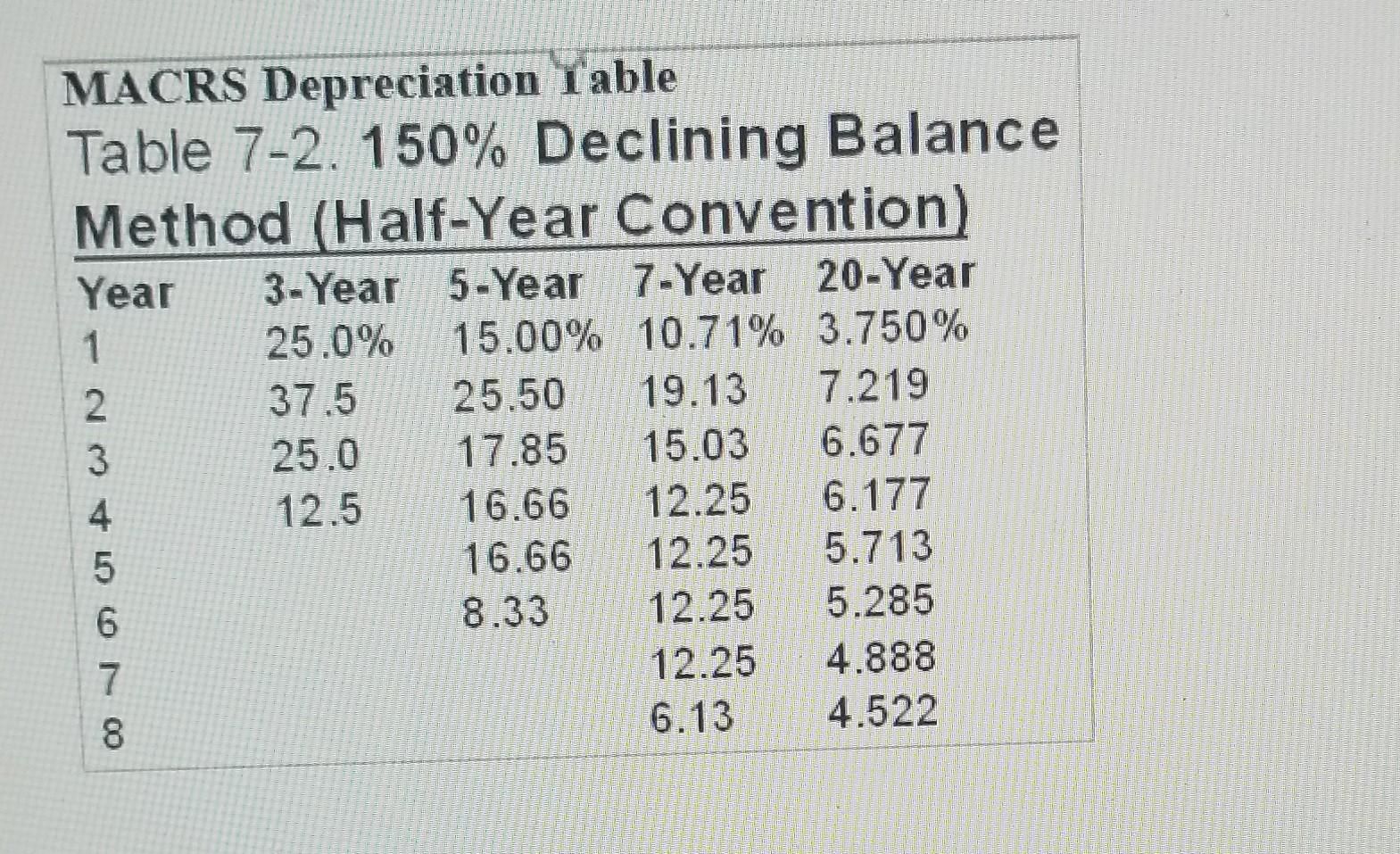

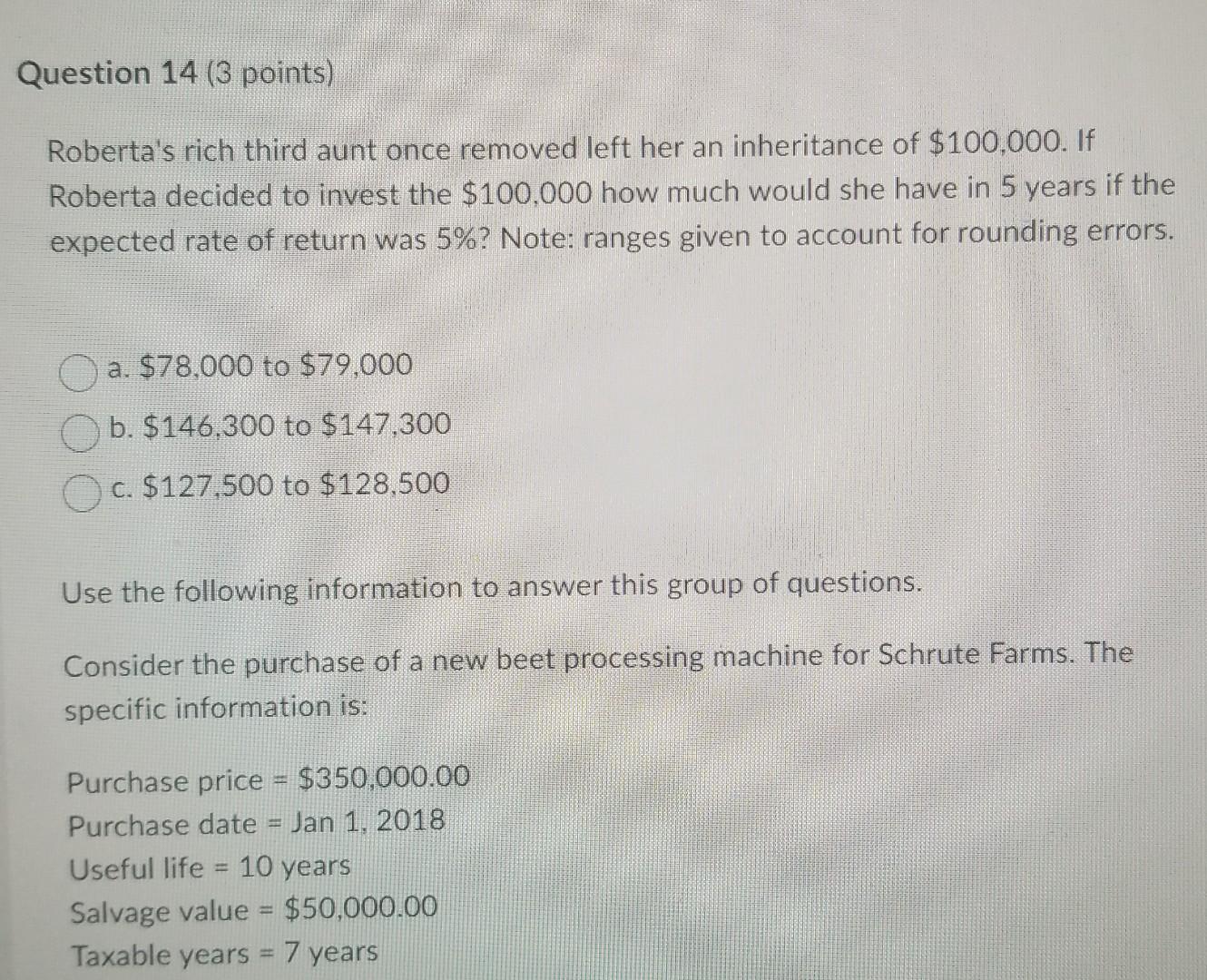

MACRS Depreciation Table Table 7-2. 150% Declining Balance Method (Half-Year Convention) Year 3-Year 5-Year 7-Year 20-Year 25.0% 15.00% 10.71% 3.750% 2 37.5 25.50 19.13 7.219 3 25.0 17.85 15.03 6.677 4 12.5 16.66 12.25 6.177 5 16.66 12.25 5.713 6 8.33 12.25 5.285 7 12.25 4.888 8 6.13 4.522 000 S N MACRS Depreciation Table Table 7-2. 150% Declining Balance Method (Half-Year Convention) Year 3-Year 5-Year 7-Year 20-Year 25.0% 15.00% 10.71% 3.750% 2 37.5 25.50 19.13 7.219 3 25.0 17.85 15.03 6.677 4 12.5 16.66 12.25 6.177 5 16.66 12.25 5.713 6 8.33 12.25 5.285 7 12.25 4.888 8 6.13 4.522 000 S N Question 14 (3 points) Roberta's rich third aunt once removed left her an inheritance of $100,000. If Roberta decided to invest the $100,000 how much would she have in 5 years if the expected rate of return was 5%? Note: ranges given to account for rounding errors. a. $78,000 to $79,000 b. $146,300 to $147,300 oc. $127,500 to $128,500 Use the following information to answer this group of questions. Consider the purchase of a new beet processing machine for Schrute Farms. The specific information is: Purchase price = $350,000.00 Purchase date = Jan 1. 2018 Useful life = 10 years Salvage value = $50,000.00 Taxable years = 7 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts