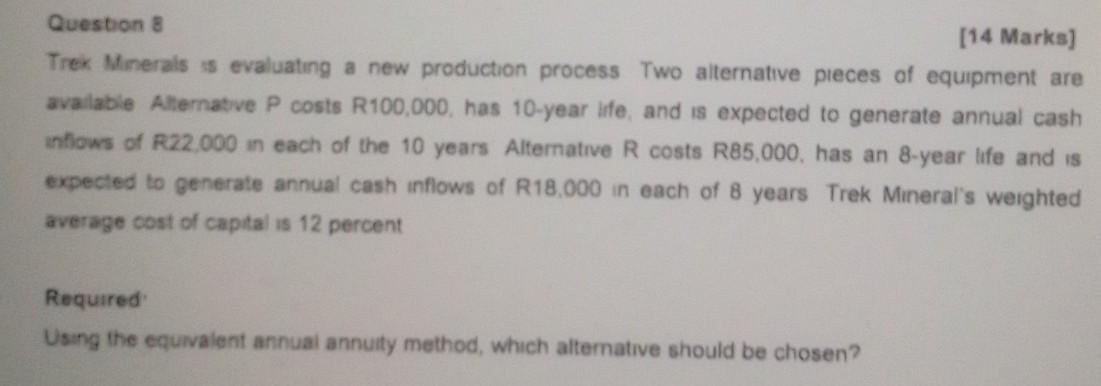

Question: Question & [14 Marks) Trek Minerals is evaluating a new production process Two alternative pieces of equipment are available Alternative P costs R100,000, has 10-year

Question & [14 Marks) Trek Minerals is evaluating a new production process Two alternative pieces of equipment are available Alternative P costs R100,000, has 10-year life, and is expected to generate annual cash indows of R22,000 in each of the 10 years Alternative R costs R85,000, has an 8-year life and is expected to generate annual cash inflows of R18,000 in each of 8 years Trek Mineral's weighted average cost of capital is 12 percent Required Using the equivalent annual annuity method, which alternative should be chosen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts