Question: Question 14 Not yet answered If hedging cannot reduce the discount rate a firm applies to value its cash flows, then hedging must increase expected

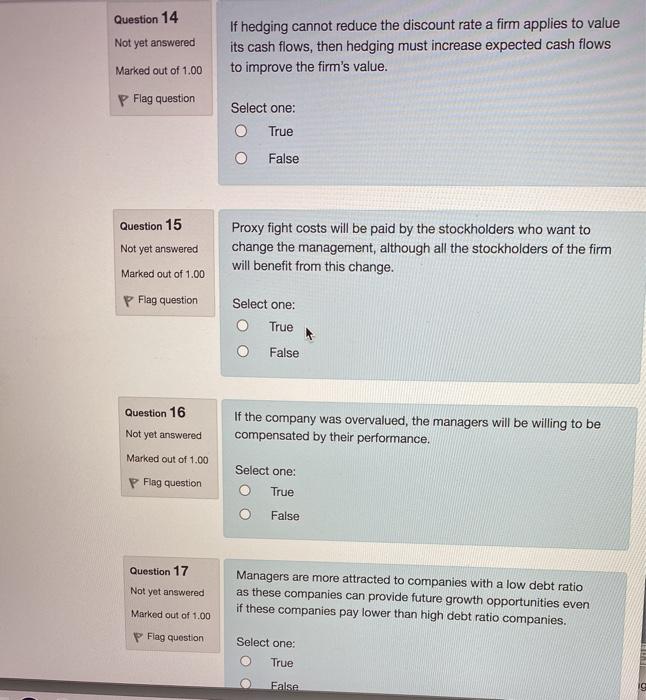

Question 14 Not yet answered If hedging cannot reduce the discount rate a firm applies to value its cash flows, then hedging must increase expected cash flows to improve the firm's value. Marked out of 1.00 P Flag question Select one: True False Question 15 Not yet answered Marked out of 1.00 p Flag question Proxy fight costs will be paid by the stockholders who want to change the management, although all the stockholders of the firm will benefit from this change. Select one: True False Question 16 Not yet answered If the company was overvalued, the managers will be willing to be compensated by their performance. Marked out of 1.00 Select one: P Flag question True False Question 17 Not yet answered Managers are more attracted to companies with a low debt ratio as these companies can provide future growth opportunities even if these companies pay lower than high debt ratio companies. Marked out of 1.00 Flag question Select one: True False C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts