Question: Question 14: Practice Please show work,no excel! Thank you :) 14. [Extra +1] The managers of JJ's Enterprises are trying to determine the company's optimal

Question 14: Practice

Please show work,no excel!

Thank you :)

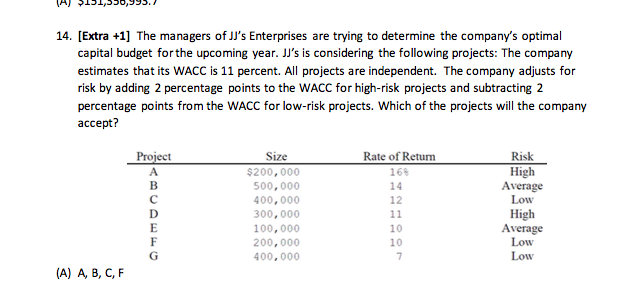

14. [Extra +1] The managers of JJ's Enterprises are trying to determine the company's optimal capital budget for the upcoming year. JJ's is considering the following projects: The company estimates that its WACC is 11 percent. All projects are independent. The company adjusts for risk by adding 2 percentage points to the WACC for high-risk projects and subtracting 2 percentage points from the WACC for low-risk projects. Which of the projects will the company accept? Size $200, 000 500,000 400, 000 300, 000 100,000 200,000 400,000 Rate of Return 168 14 12 Risk High Average Pro Low High Average 10 10 (A) A, B, C,F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts