Question: Question 1.4 (Total: 30 marks; 3 marks each) Chapter 2 introduces you to the foundational principles of accounting, which are as follows: Recognition/De Measurement Presentation

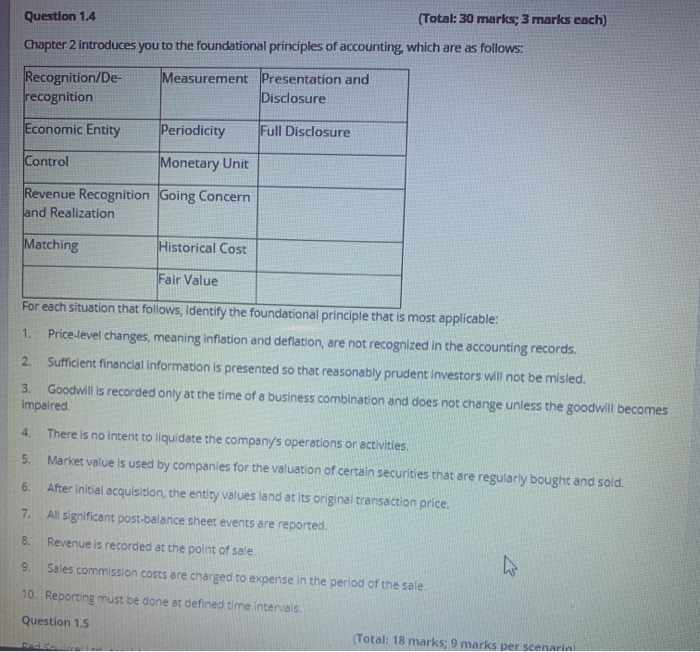

Question 1.4 (Total: 30 marks; 3 marks each) Chapter 2 introduces you to the foundational principles of accounting, which are as follows: Recognition/De Measurement Presentation and recognition Disclosure Economic Entity Periodicity Full Disclosure Control Monetary Unit Revenue Recognition Going Concern and Realization Matching Historical Cost Fair Value For each situation that follows, identify the foundational principle that is most applicable: 1. Price-level changes, meaning inflation and deflation, are not recognized in the accounting records. 2. Sufficient financial information is presented so that reasonably prudent investors will not be misled. 3. Goodwill is recorded only at the time of a business combination and does not change unless the goodwill becomes impaired 4. There is no intent to liquidate the company's operations or activities 5. Market value is used by companies for the valuation of certain securities that are regularly bought and sold. 6. After initial acquisition, the entity values and at its original transaction price. 7. All significant post-balance sheet events are reported. 8. Revenue is recorded at the point of sale 9. Sales commission costs are charged to expense in the period of the sale. 10. Reporting must be done at defined time intervals. Question 1.5 (Total: 18 marks; 9 marks per scenari

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts