Question: Question 14/15 please Principles 1 - Summer 2018 Principles Study Guide for Debt Chapters Principles 1 - Summer 2018 Principles Study Guide for Debt Chapters

Question 14/15 please

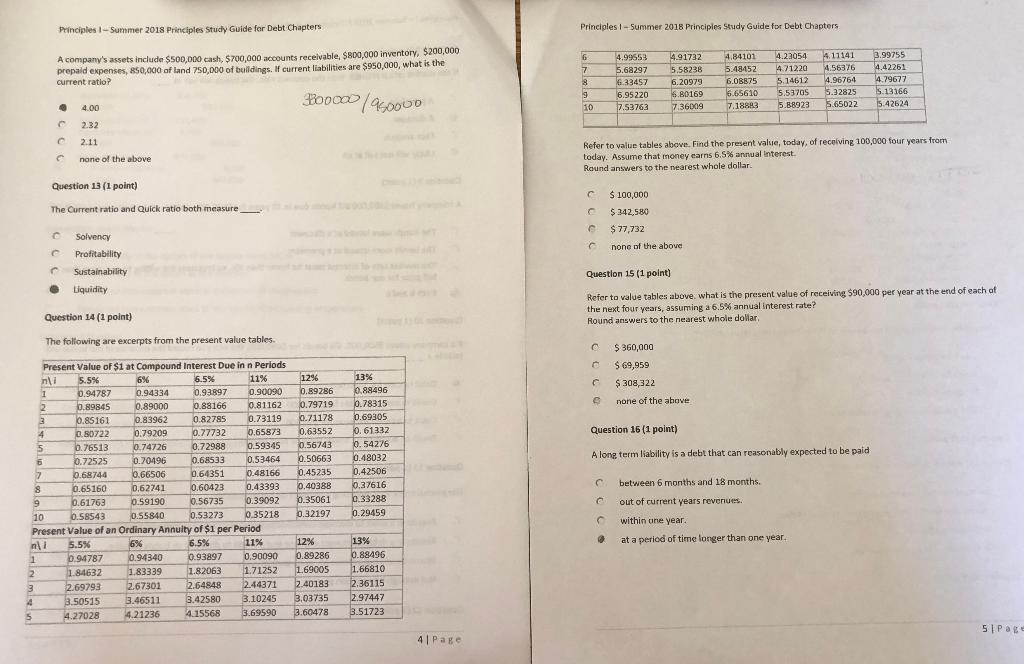

Principles 1 - Summer 2018 Principles Study Guide for Debt Chapters Principles 1 - Summer 2018 Principles Study Guide for Debt Chapters A company's assets include $500,000 cash, $700,000 accounts receivable, $800,000 inventory, $200,000 prepaid expenses, 850,000 of land 750,000 of buildings. If current liabilities are $950,000, what is the current ratio? G 7 8 9 10 4.99553 5.68297 633457 6.95220 7.53763 4.91732 5.58238 6.20979 6.80169 7.36009 4.84101 5.48452 6.08875 6.65610 7.18883 4.22054 4.71220 5.14612 5.53705 5.88923 4.11141 4.56376 4.96764 5.32825 5.65022 3.99755 4.42261 14.79677 5.13166 5.42624 B00001950000 4.00 2.11 none of the above Refer to value tables above. Find the present value, today, of receiving 100,000 four years from today. Assume that money earns 6.5% annual interest Round answers to the nearest whole dollar. Question 13 (1 point) The Current ratio and Quick ratio both measure $ 100,000 $ $ 342,580 $ 77,732 none of the above Solvency Profitability Sustainability Liquidity Question 15 (1 point) Question 14 (1 point) 1 Refer to value tables above. what is the present value of receiving $90,000 per year at the end of each of the next four years, assuming a 6.5% annual interest rate? Round answers to the nearest whole dollar The following are excerpts from the present value tables $360,000 $ 69,959 $ 308,322 none of the above 0.71178 Question 16 (1 point) 13% 0.88496 0.78315 0.69305 10. 61332 0.54276 0.48032 0.42506 0.37616 0.33288 0.29459 A long term liability is a debt that can reasonably expected to be paid Present Value of $1 at Compound Interest Due in n Periods ni 5.5% 6% 6.5% 11% 1296 1 0.94787 0.94334 0.93897 0.90090 0.89286 2 0.89845 0.89000 0.88166 0.81162 0.79719 0.85161 0.83962 0.82785 0.73119 4 0.80722 0.79209 0.77732 0.65873 0.63552 5 6.76513 0.74726 0.72988 0.59345 0.56743 6 0.72525 0.70496 0.68533 0.53464 0.50663 2 0.68744 0.66506 0.64351 0.48166 0.45235 8 0.65160 0,62741 0.60423 0.43393 0.40388 9 0.61763 0.59190 0.56735 0.35061 10 b 58543 0.55840 0.53273 0.35218 0.32197 Present Value of an ordinary Annuity of $1 per Period ni 5.5% 6% 6.5% 11% 12% 1 0.94787 0.94340 0.93897 0.90090 0.89286 2 1.84632 1.83339 1.82063 1.71252 1.69005 3 2.69793 2.67301 2.64848 2.44371 2.40183 4 3.50515 3.46511 3.42580 3.10245 3,03735 5 4.27028 4.21236 4.15568 3.69590 3.60478 between 6 months and 18 months. 0.39092 out of current years revenues within one year. at a period of time longer than one year. 13% 0.88496 1.66810 2.36115 2.97447 3.51723 5 Page 41 Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts