Question: question 14-15 you can read the points i just need a short answer 14. Sai Nguyen: $895.46 weekly earnings, 2 withholding allowances, single, credit union

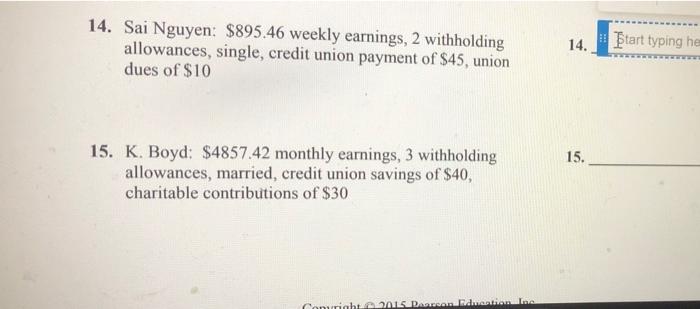

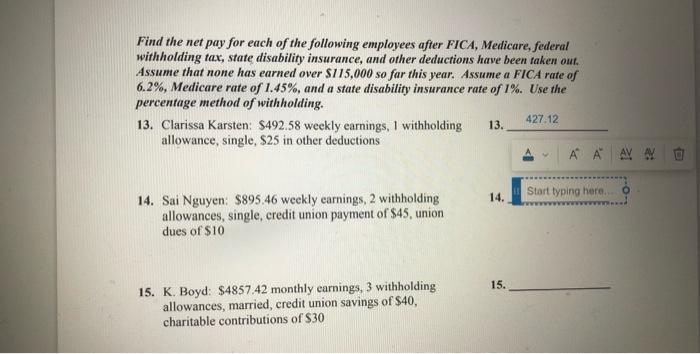

14. Sai Nguyen: $895.46 weekly earnings, 2 withholding allowances, single, credit union payment of $45, union dues of $10 14. Start typing he 15. 15. K. Boyd: $4857.42 monthly earnings, 3 withholding allowances, married, credit union savings of $40, charitable contributions of $30 Comuright 2015 Deception Find the net pay for each of the following employees after FICA, Medicare, federal withholding tax, state disability insurance, and other deductions have been taken out. Assume that none has earned over $115,000 so far this year. Assume a FICA rate of 6.2%, Medicare rate of 1.45%, and a state disability insurance rate of 1%. Use the percentage method of withholding. 13. Clarissa Karsten: $492.58 weekly earnings, I withholding 13. 427.12 allowance, single, $25 in other deductions AV A 14. Start typing here 14. Sai Nguyen: $895.46 weekly earnings, 2 withholding allowances, single, credit union payment of $45, union dues of $10 15. 15. K. Boyd: $4857.42 monthly carnings, 3 withholding allowances, married, credit union savings of $40, charitable contributions of $30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts