Question: Question 15 (1 point) You currently hold a 4-year fixed rate bond paying 5% annually. You would like to hedge against changes in the level

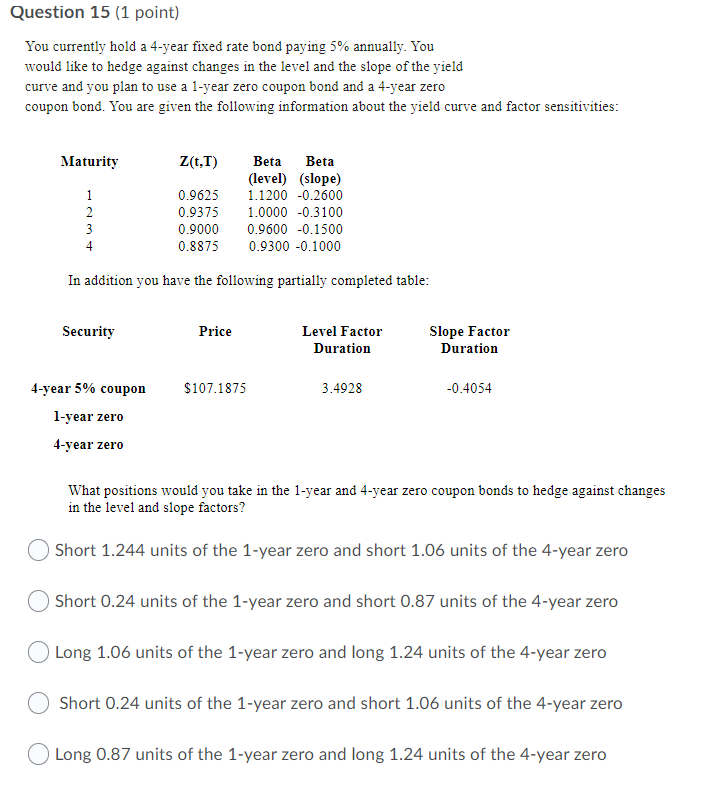

Question 15 (1 point) You currently hold a 4-year fixed rate bond paying 5% annually. You would like to hedge against changes in the level and the slope of the yield curve and you plan to use a 1-year zero coupon bond and a 4-year zero coupon bond. You are given the following information about the yield curve and factor sensitivities: Maturity Z(t.1) 1 2 3 4 cm + Beta Beta (level) (slope) 1.1200 -0.2600 1.0000 -0.3100 0.9600 -0.1500 0.9300 -0.1000 0.9625 0.9375 0.9000 0.8875 In addition you have the following partially completed table: Security Price Level Factor Duration Slope Factor Duration $107.1875 3.4928 -0.4054 4-year 5% coupon 1-year zero 4-year zero What positions would you take in the 1-year and 4-year zero coupon bonds to hedge against changes in the level and slope factors? Short 1.244 units of the 1-year zero and short 1.06 units of the 4-year zero Short 0.24 units of the 1-year zero and short 0.87 units of the 4-year zero Long 1.06 units of the 1-year zero and long 1.24 units of the 4-year zero Short 0.24 units of the 1-year zero and short 1.06 units of the 4-year zero Long 0.87 units of the 1-year zero and long 1.24 units of the 4-year zero Question 15 (1 point) You currently hold a 4-year fixed rate bond paying 5% annually. You would like to hedge against changes in the level and the slope of the yield curve and you plan to use a 1-year zero coupon bond and a 4-year zero coupon bond. You are given the following information about the yield curve and factor sensitivities: Maturity Z(t.1) 1 2 3 4 cm + Beta Beta (level) (slope) 1.1200 -0.2600 1.0000 -0.3100 0.9600 -0.1500 0.9300 -0.1000 0.9625 0.9375 0.9000 0.8875 In addition you have the following partially completed table: Security Price Level Factor Duration Slope Factor Duration $107.1875 3.4928 -0.4054 4-year 5% coupon 1-year zero 4-year zero What positions would you take in the 1-year and 4-year zero coupon bonds to hedge against changes in the level and slope factors? Short 1.244 units of the 1-year zero and short 1.06 units of the 4-year zero Short 0.24 units of the 1-year zero and short 0.87 units of the 4-year zero Long 1.06 units of the 1-year zero and long 1.24 units of the 4-year zero Short 0.24 units of the 1-year zero and short 1.06 units of the 4-year zero Long 0.87 units of the 1-year zero and long 1.24 units of the 4-year zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts