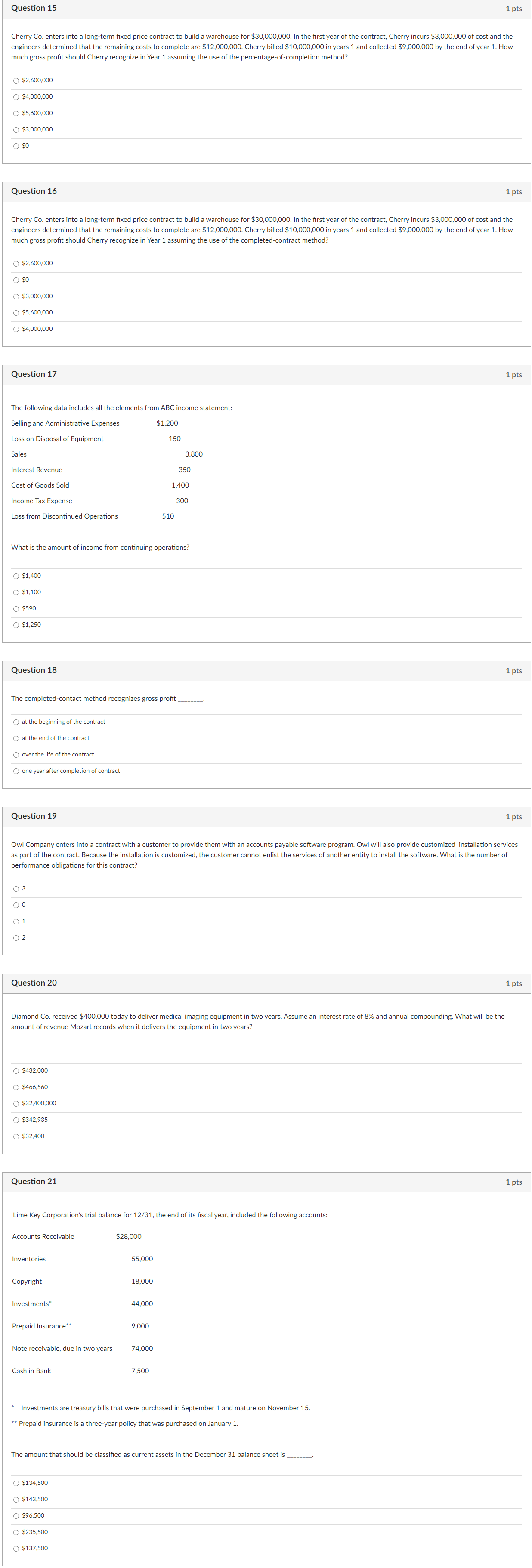

Question: Question 15 1 pts Cherry Co. enters into a long-term fixed price contract to build a warehouse for $30,000,000. In the first year of the

Question 15 1 pts Cherry Co. enters into a long-term fixed price contract to build a warehouse for $30,000,000. In the first year of the contract, Cherry incurs $3,000,000 of cost and the engineers determined that the remaining costs to complete are $12,000,000. Cherry billed $10,000,000 in years 1 and collected $9,000,000 by the end of year 1. How much gross profit should Cherry recognize in Year 1 assuming the use of the percentage-of-completion method? $2,600,000 $4,000,000 $5,600,000 $3,000,000 SO Question 16 1 pts Cherry Co. enters into a long-term fixed price contract to build a warehouse for $30,000,000. In the first year of the contract, Cherry incurs $3,000,000 of cost and the engineers determined that the remaining costs to complete are $12,000,000. Cherry billed $10,000,000 in years 1 and collected $9,000,000 by the end of year 1. How much gross profit should Cherry recognize in Year 1 assuming the use of the completed-contract method? $2,600,000 $3,000,000 O $5,600,000 $4,000,000 Question 17 1 pts The following data includes all the elements from ABC income statement: Selling and Administrative Expenses $1,200 Loss on Disposal of Equipment 150 Sales 3,800 Interest Revenue 350 Cost of Goods Sold 1,400 Income Tax Expense 300 Loss from Discontinued Operations 510 What is the amount of income from continuing operations? O $1,400 O $1,100 O $590 O $1,250 Question 18 1 pts The completed-contact method recognizes gross profit _ O at the beginning of the contract O at the end of the contract O over the life of the contract O one year after completion of contract Question 19 1 pts Owl Company enters into a contract with a customer to provide them with an accounts payable software program. Owl will also provide customized installation services as part of the contract. Because the installation is customized, the customer cannot enlist the services of another entity to install the software. What is the number of performance obligations for this contract? 0 3 0 1 02 Question 20 1 pts Diamond Co. received $400,000 today to deliver medical imaging equipment in two years. Assume an interest rate of 8% and annual compounding. What will be the amount of revenue Mozart records when it delivers the equipment in two years? O $432,000 $466,560 ( $32,400,000 $342,935 ( $32.400 Question 21 1 pts Lime Key Corporation's trial balance for 12/31, the end of its fiscal year, included the following accounts: Accounts Receivable $28,000 Inventories 55,000 Copyright 18,000 Investments' 44.000 Prepaid Insurance"* 9.000 Note receivable, due in two years 74.000 Cash in Bank 7,500 Investments are treasury bills that were purc ber 1 and mature on November 15. *Prepaid insurance is a three-year policy that was purchased on January 1. The amount that should be classified as current assets in the December 31 balance sheet is _ _ O $134,500 O $143,500 $96,500 O $235,500 O $137,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts