Question: Question 15 (10 points) One year has passed since Lyia opened Zozo's restaurant. You convinced Lyla about the importance of ratio analysis. She agreed to

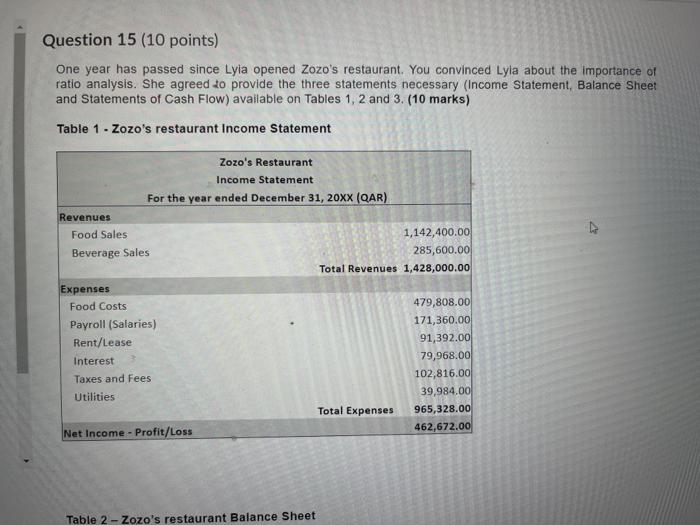

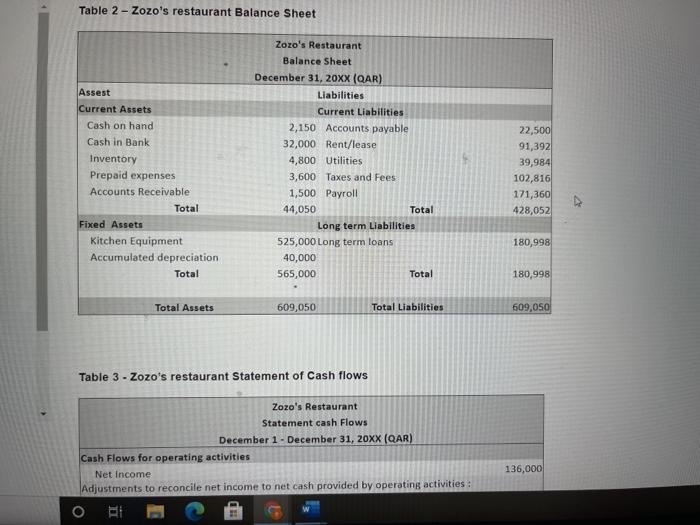

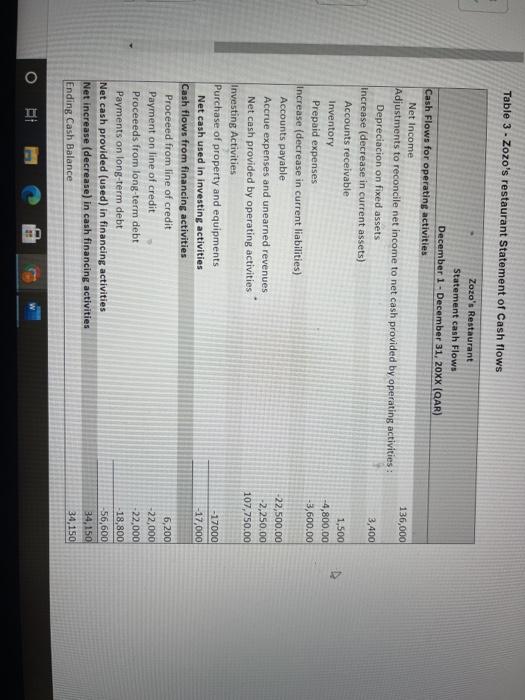

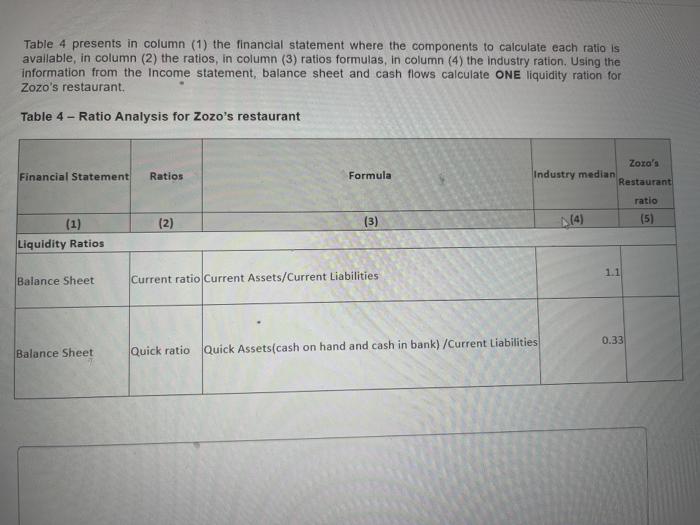

Question 15 (10 points) One year has passed since Lyia opened Zozo's restaurant. You convinced Lyla about the importance of ratio analysis. She agreed to provide the three statements necessary (Income Statement, Balance Sheet and Statements of Cash Flow) available on Tables 1, 2 and 3. (10 marks) Table 1 - Zozo's restaurant Income Statement Zozo's Restaurant Income Statement For the year ended December 31, 20XX (QAR) Revenues Food Sales 1,142,400.00 Beverage Sales 285,600.00 Total Revenues 1,428,000.00 Expenses Food Costs 479,808.00 Payroll (Salaries) 171,360.00 Rent/Lease 91,392.00 Interest 79,968.00 Taxes and Fees 102,816.00 Utilities 39,984.00 Total Expenses 965,328.00 Net Income - Profit/Loss 462,672.00 Table 2- Zozo's restaurant Balance Sheet Table 2- Zozo's restaurant Balance Sheet Assest Current Assets Cash on hand Cash in Bank Inventory Prepaid expenses Accounts Receivable Total Fixed Assets Kitchen Equipment Accumulated depreciation Total Zozo's Restaurant Balance Sheet December 31, 20xx (QAR) Liabilities Current Liabilities 2,150 Accounts payable 32,000 Rent/lease 4,800 Utilities 3,600 Taxes and Fees 1,500 Payroll 44,050 Total Long term Liabilities 525,000 Long term loans 40,000 565,000 Total 22,500 91,392 39,984 102,816 171,360 428,052 180,998 180,998 Total Assets 609,050 Total Liabilities 609,050 Table 3 - Zozo's restaurant Statement of Cash flows Zozo's Restaurant Statement cash Flows December 1 - December 31, 20XX (QAR) Cash Flows for operating activities Net Income Adjustments to reconcile net income to net cash provided by operating activities : ORI 136,000 Table 3 - Zozo's restaurant Statement of Cash flows 136,000 3,400 1,500 -4,800.00 - 3,600.00 Zozo's Restaurant Statement cash Flows December 1 - December 31, 20XX (QAR) Cash Flows for operating activities Net Income Adjustments to reconcile net income to net cash provided by operating activities: Depreciacion on fixed assets increase (decrease in current assets) Accounts receivable Inventory Prepaid expenses Increase (decrease in current liabilities) Accounts payable Accrue expenses and unearned revenues Net cash provided by operating activities Investing Activities Purchase of property and equipments Net cash used in investing activities Cash flows from financing activities Proceeed from line of credit Payment on line of credit Proceeeds from long-term debt Payments on long-term debt Net cash provided (used) in financing activities Net increase (decrease) in cash financing activities Ending Cash Balance -22,500.00 -2,250.00 107,750.00 - 17000 -17,000 6,200 -22,000 -22,000 -18,800 -56,600 34,150 34,150 o BE Table 4 presents in column (1) the financial statement where the components to calculate each ratio is available, in column (2) the ratios, in column (3) ratios formulas, in column (4) the industry ration. Using the information from the Income statement, balance sheet and cash flows calculate ONE liquidity ration for Zozo's restaurant. Table 4 - Ratio Analysis for Zozo's restaurant Financial Statement Ratios Formula Zora's Industry median Restaurant ratio (5) (2) (3) (1) Liquidity Ratios 1.1 Balance Sheet Current ratio Current Assets/Current Liabilities 0.33 Balance Sheet Quick ratio Quick Assets(cash on hand and cash in bank) /Current Liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts