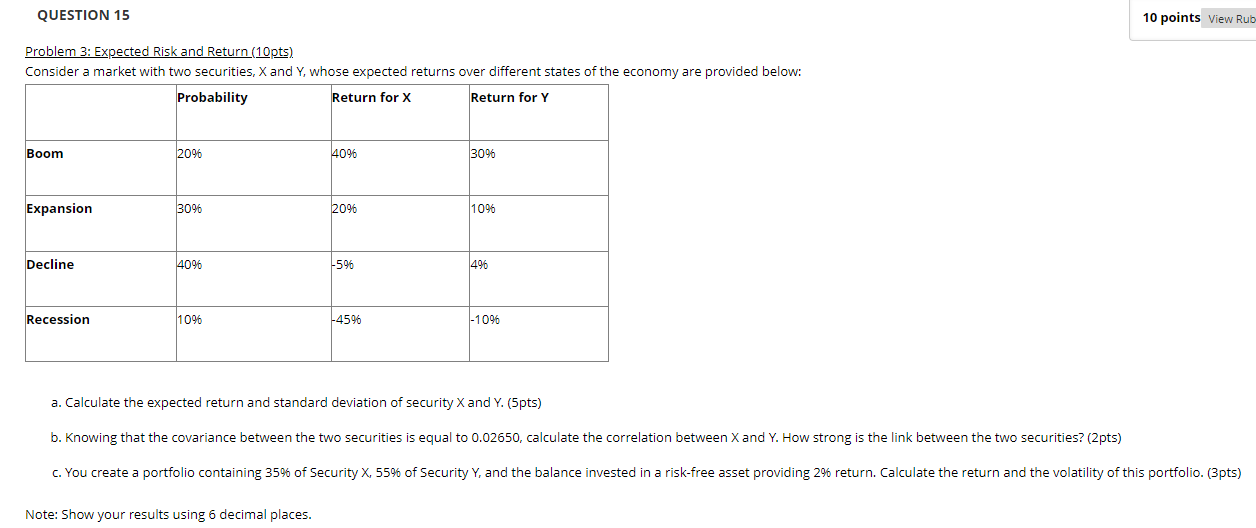

Question: QUESTION 15 10 points View Rub Problem 3: Expected Risk and Return (10pts) Consider a market with two securities, X and Y, whose expected returns

QUESTION 15 10 points View Rub Problem 3: Expected Risk and Return (10pts) Consider a market with two securities, X and Y, whose expected returns over different states of the economy are provided below: Probability Return for X Return for Y Boom 2096 4096 30% Expansion 3096 20% 1096 Decline 4096 -596 496 Recession 1096 -4596 -1096 a. Calculate the expected return and standard deviation of security X and Y. (5pts) b. Knowing that the covariance between the two securities is equal 0.02650, calculate the correlation between X and Y. How strong is the link between the two securities? (2pts) C. You create a portfolio containing 35% of Security X, 55% of Security Y, and the balance invested in a risk-free asset providing 2% return. Calculate the return and the volatility of this portfolio. (3pts) Note: Show your results using 6 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts