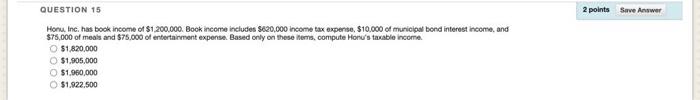

Question: QUESTION 15 2 points Save Answer Honu, Inc. has book income of $1.200.000. Book income includes 5620,000 income tax expertise, $10.000 of municipal bond interest

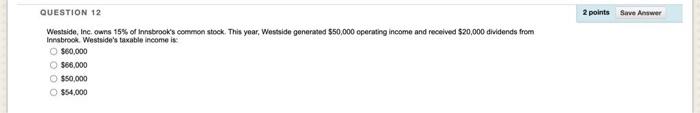

QUESTION 15 2 points Save Answer Honu, Inc. has book income of $1.200.000. Book income includes 5620,000 income tax expertise, $10.000 of municipal bond interest income, and $75,000 of meals and $75.000 of entertainment expense. Based only on these items, compute Hone's taxable income 51.820,000 $1,905,000 O $1,960,000 O 51.922,500 QUESTION 12 2 points Serve Answer Westside, Inc. owns 15% of Innsbrook's common stock. This year, Westside generated $50,000 operating income and received $20,000 dividends from Innsbrook, Westside's taxable income is O $60,000 566,000 550.000 $54,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts