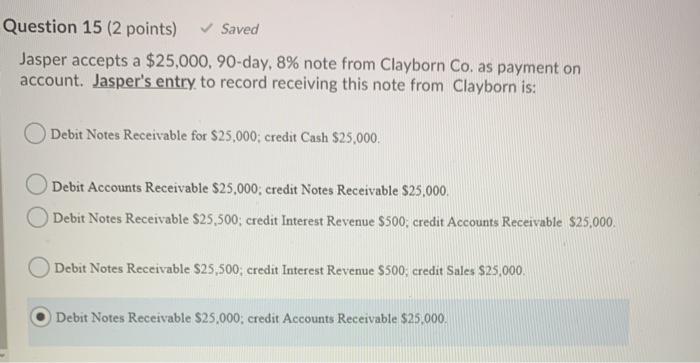

Question: Question 15 (2 points) Saved Jasper accepts a $25,000, 90-day, 8% note from Clayborn Co. as payment on account. Jasper's entry to record receiving this

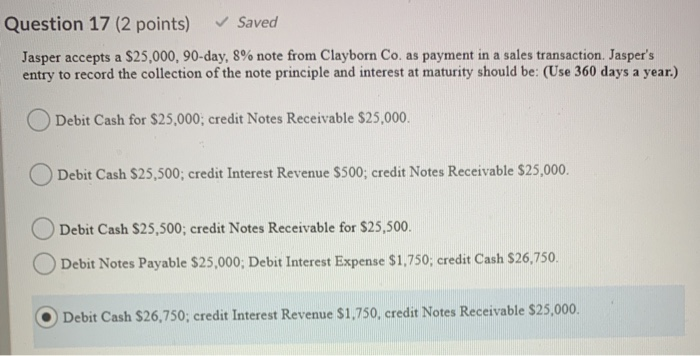

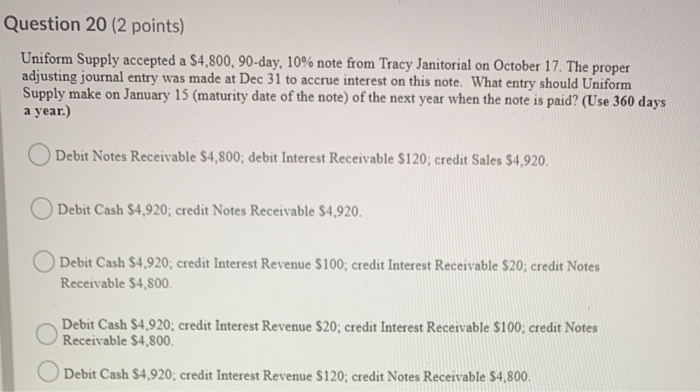

Question 15 (2 points) Saved Jasper accepts a $25,000, 90-day, 8% note from Clayborn Co. as payment on account. Jasper's entry to record receiving this note from Clayborn is: O Debit Notes Receivable for $25,000; credit Cash $25,000. O Debit Accounts Receivable $25,000; credit Notes Receivable $25,000. O Debit Notes Receivable $25,500; credit Interest Revenue $500: credit Accounts Receivable $25,000. O Debit Notes Receivable $25,500; credit Interest Revenue $500; credit Sales $25,000. O Debit Notes Receivable $25,000; credit Accounts Receivable $25,000. Question 17 (2 points) Saved Jasper accepts a $25,000, 90-day, 8% note from Clayborn Co. as payment in a sales transaction. Jasper's entry to record the collection of the note principle and interest at maturity should be: (Use 360 days a year.) O Debit Cash for $25,000; credit Notes Receivable $25,000. O Debit Cash $25,500; credit Interest Revenue $500; credit Notes Receivable $25,000. O Debit Cash $25,500; credit Notes Receivable for $25,500. Debit Notes Payable $25,000; Debit Interest Expense $1,750; credit Cash $26,750. O Debit Cash $26,750; credit Interest Revenue $1,750, credit Notes Receivable $25,000. Question 20 (2 points) Uniform Supply accepted a $4,800, 90-day, 10% note from Tracy Janitorial on October 17. The proper adjusting journal entry was made at Dec 31 to accrue interest on this note. What entry should Uniform Supply make on January 15 (maturity date of the note) of the next year when the note is paid? (Use 360 days a year.) O Debit Notes Receivable $4,800; debit Interest Receivable $120; credit Sales $4,920. O Debit Cash $4,920; credit Notes Receivable $4,920. O Debit Cash $4,920; credit Interest Revenue $100; credit Interest Receivable $20, credit Notes Receivable $4,800 Debit Cash $4.920; credit Interest Revenue $20; credit Interest Receivable $100, credit Notes Receivable $4,800 Debit Cash $4,920; credit Interest Revenue $120; credit Notes Receivable $4,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts