Question: Question 15 (2.5 points) Listen What is the primary source of revenue for most banks? O A) Equity A E B) Fed Funds Purchased C)

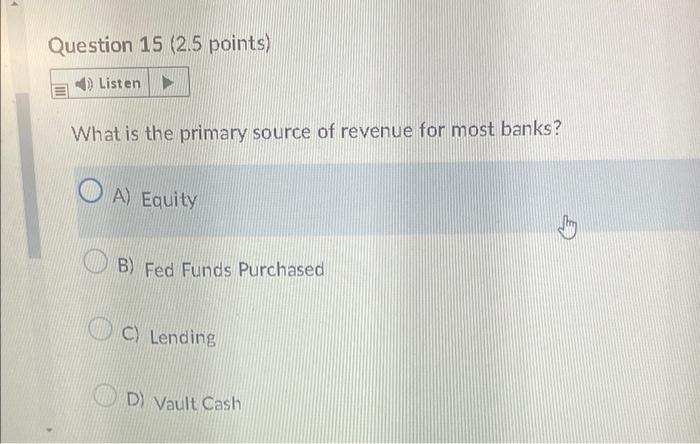

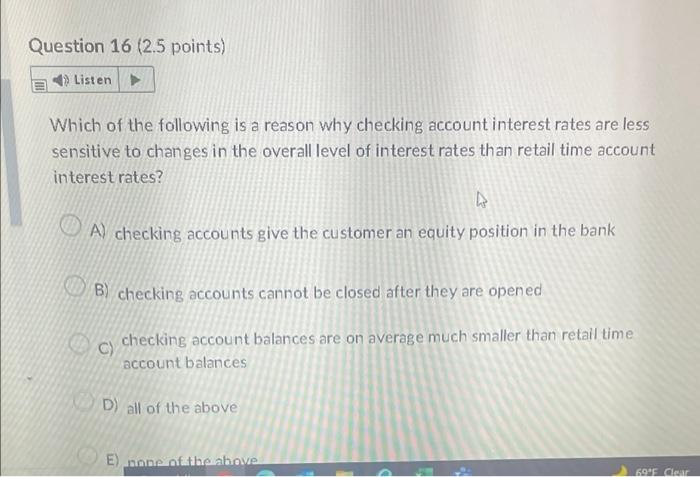

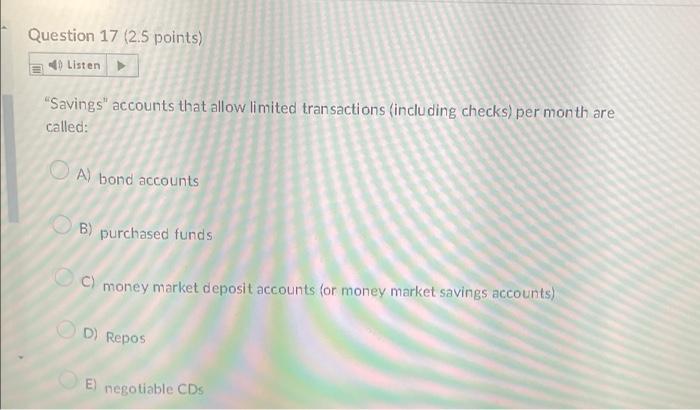

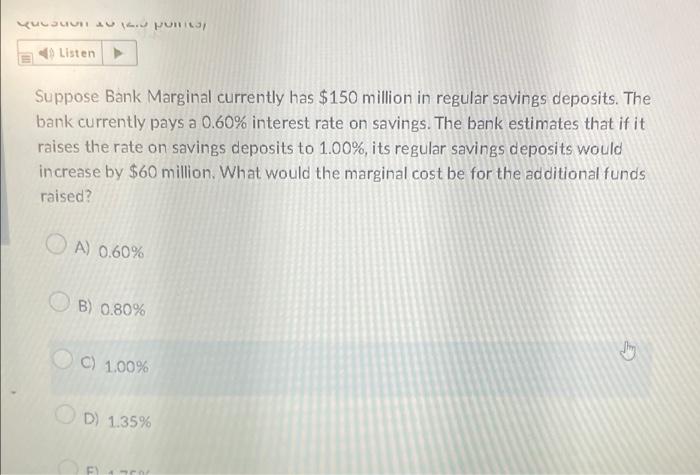

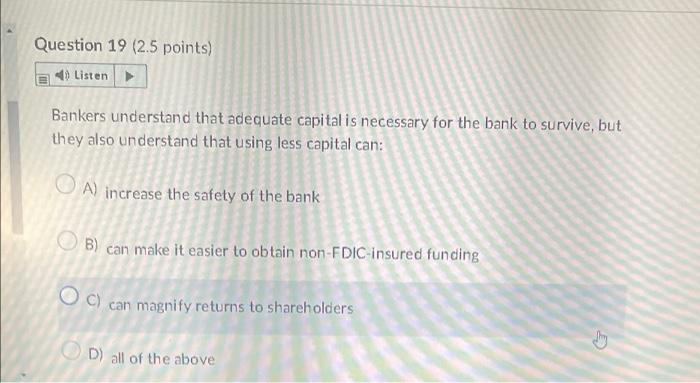

Question 15 (2.5 points) Listen What is the primary source of revenue for most banks? O A) Equity A E B) Fed Funds Purchased C) Lending D) Vault Cash Question 16 (2.5 points) Listen Which of the following is a reason why checking account interest rates are less sensitive to changes in the overall level of interest rates than retail time account interest rates? A A) checking accounts give the customer an equity position in the bank B) checking accounts cannot be closed after they are opened C) checking account balances are on average much smaller than retall time account balances D) all of the above E) none of the above 60F Clear Question 17 (2.5 points) Listen "Savings accounts that allow limited transactions (including checks) per month are called: A) bond accounts B) purchased funds c) money market deposit accounts for money market savings accounts) D) Repos El negotiable CDS KUJUULU PUNI Listen Suppose Bank Marginal currently has $150 million in regular savings deposits. The bank currently pays a 0.60% interest rate on savings. The bank estimates that if it raises the rate on savings deposits to 1.00%, its regular savings deposits would increase by $60 million. What would the marginal cost be for the additional funds raised? OA) 0.60% OB) 0.80% C) 1.00% D) 1.35% Question 19 (2.5 points) Listen Bankers understand that adequate capital is necessary for the bank to survive, but they also understand that using less capital can: O A) increase the safety of the bank B) can make it easier to obtain non-FDIC-insured funding O c) can magnify returns to shareholders D) all of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts