Question: Question 15 3 pts Project has an initial cost (today) of $10,000, will last one year, and will return $20,000 of cash flow in one

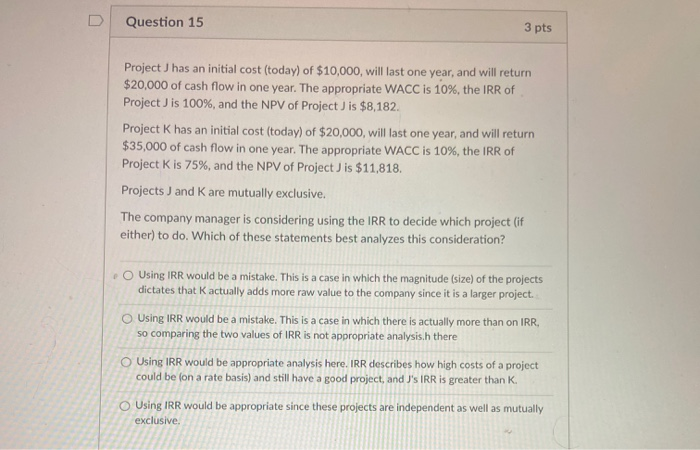

Question 15 3 pts Project has an initial cost (today) of $10,000, will last one year, and will return $20,000 of cash flow in one year. The appropriate WACC is 10%, the IRR of Project J is 100%, and the NPV of Project J is $8,182. Project K has an initial cost (today) of $20,000, will last one year, and will return $35,000 of cash flow in one year. The appropriate WACC is 10%, the IRR of Project K is 75%, and the NPV of Project is $11,818. Projects J and K are mutually exclusive. The company manager is considering using the IRR to decide which project (if either) to do. Which of these statements best analyzes this consideration? Using IRR would be a mistake. This is a case in which the magnitude (size) of the projects dictates that actually adds more raw value to the company since it is a larger project Using IRR would be a mistake. This is a case in which there is actually more than on IRR, so comparing the two values of IRR is not appropriate analysis.h there Using IRR would be appropriate analysis here. IRR describes how high costs of a project could be on a rate basis) and still have a good project, and 's IRR is greater than K. Using IRR would be appropriate since these projects are independent as well as mutually exclusive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts