Question: Question 15 3.34 pts CPB International evaluates capital projects using the net present value, internal rate of return, profitability index, and payback methods. A project

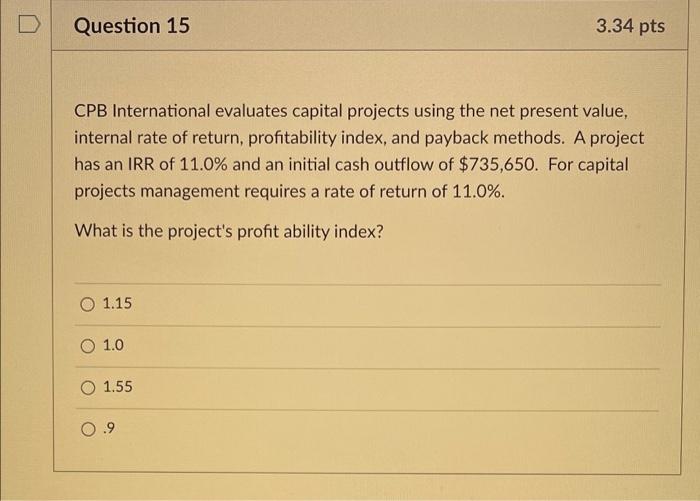

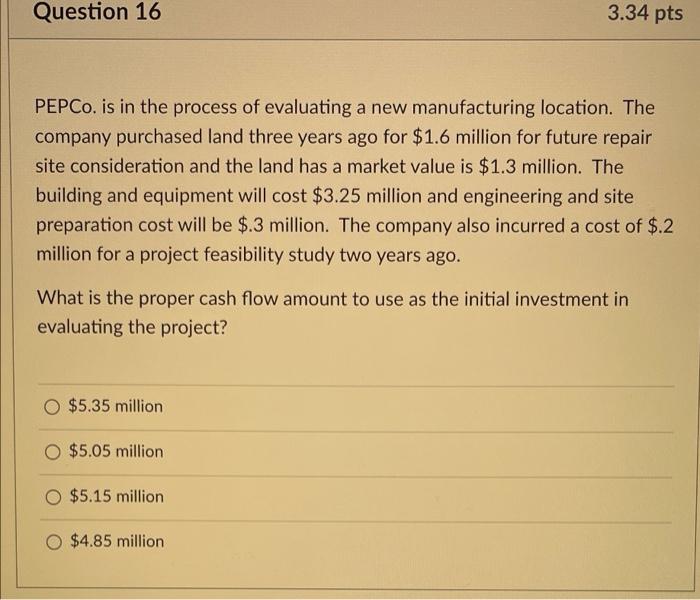

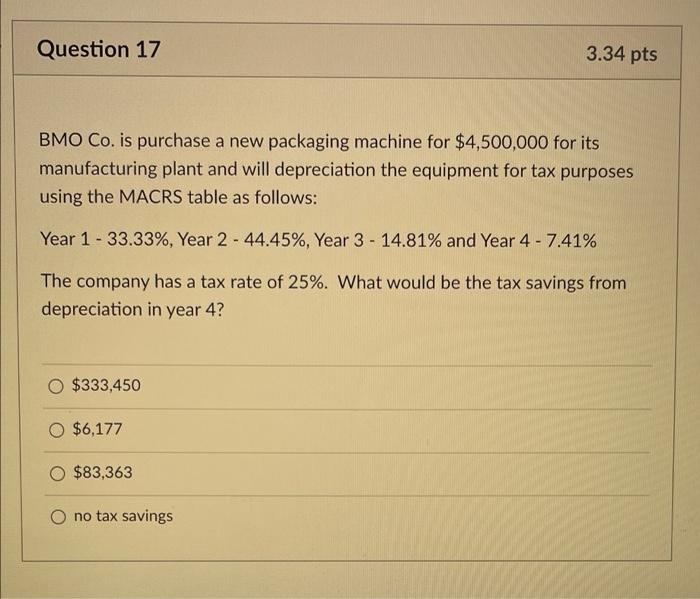

Question 15 3.34 pts CPB International evaluates capital projects using the net present value, internal rate of return, profitability index, and payback methods. A project has an IRR of 11.0% and an initial cash outflow of $735,650. For capital projects management requires a rate of return of 11.0%. What is the project's profit ability index? O 1.15 O 1.0 O 1.55 0.9 Question 16 3.34 pts PEPCo. is in the process of evaluating a new manufacturing location. The company purchased land three years ago for $1.6 million for future repair site consideration and the land has a market value is $1.3 million. The building and equipment will cost $3.25 million and engineering and site preparation cost will be $.3 million. The company also incurred a cost of $.2 million for a project feasibility study two years ago. What is the proper cash flow amount to use as the initial investment in evaluating the project? $5.35 million $5.05 million O $5.15 million $4.85 million Question 17 3.34 pts BMO Co. is purchase a new packaging machine for $4,500,000 for its manufacturing plant and will depreciation the equipment for tax purposes using the MACRS table as follows: Year 1 - 33.33%, Year 2 - 44.45%, Year 3 - 14.81% and Year 4 - 7.41% The company has a tax rate of 25%. What would be the tax savings from depreciation in year 4? $333,450 $6,177 $83,363 no tax savings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts