Question: QUESTION 15 4 points Save Answer Pineapple Company has a book value of $40 per share, and is currently trading at a price of $90

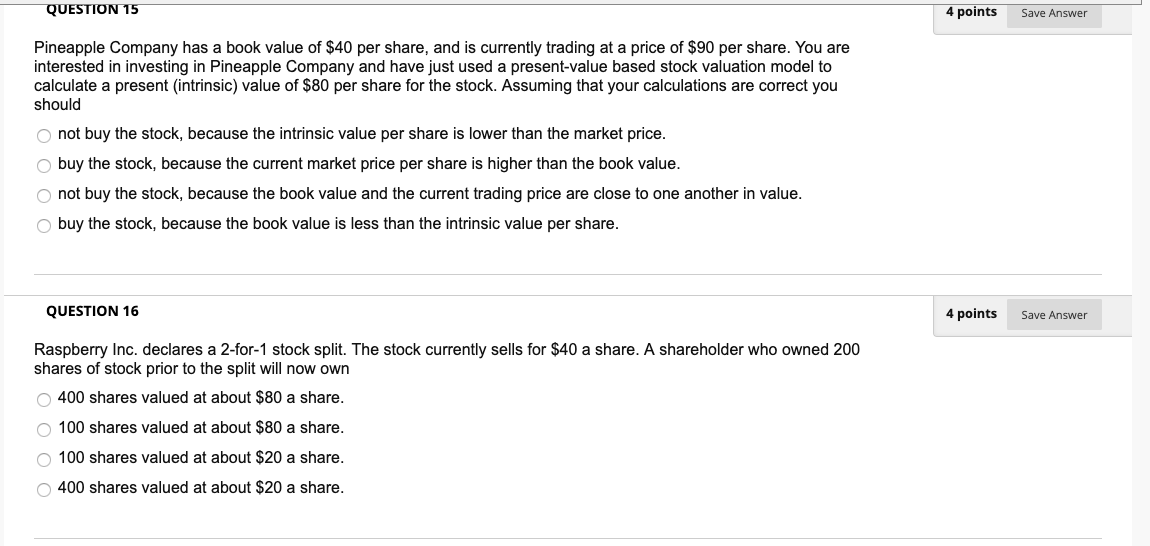

QUESTION 15 4 points Save Answer Pineapple Company has a book value of $40 per share, and is currently trading at a price of $90 per share. You are interested in investing in Pineapple Company and have just used a present-value based stock valuation model to calculate a present (intrinsic) value of $80 per share for the stock. Assuming that your calculations are correct you should o not buy the stock, because the intrinsic value per share is lower than the market price. o buy the stock, because the current market price per share is higher than the book value. o not buy the stock, because the book value and the current trading price are close to one another in value. o buy the stock, because the book value is less than the intrinsic value per share. QUESTION 16 4 points Save Answer Raspberry Inc. declares a 2-for-1 stock split. The stock currently sells for $40 a share. A shareholder who owned 200 shares of stock prior to the split will now own 400 shares valued at about $80 a share. o 100 shares valued at about $80 a share 100 shares valued at about $20 a share. 400 shares valued at about $20 a share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts