Question: Question 15 6 points Save Answer Tiger King, Inc. makes powdered protein drinks. It needs to buy a new machine that will drain whey from

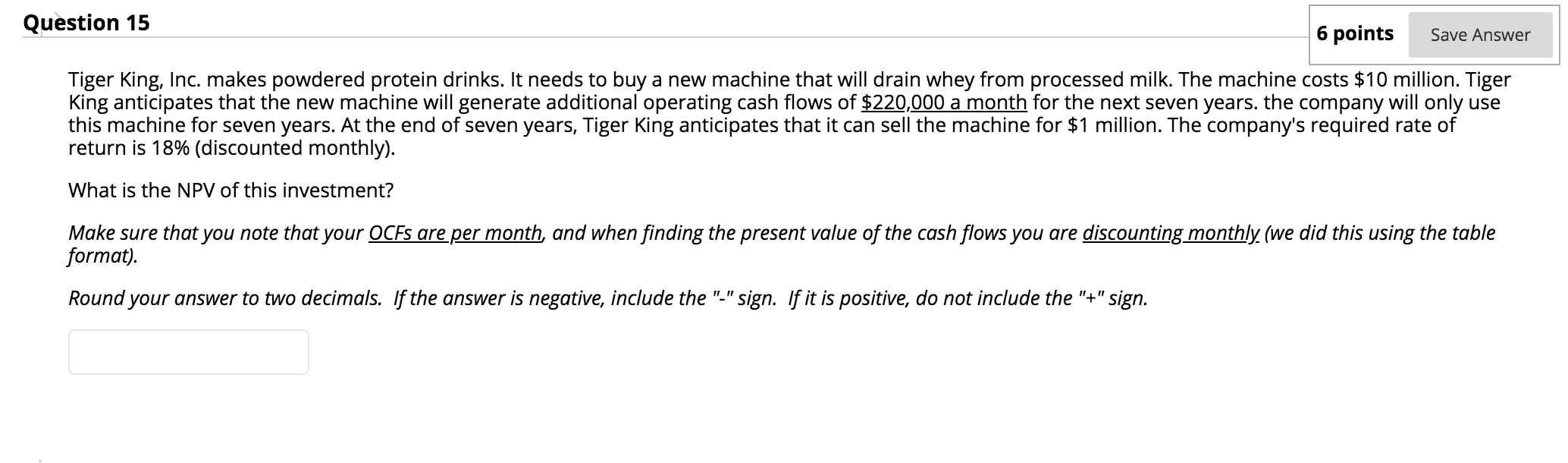

Question 15 6 points Save Answer Tiger King, Inc. makes powdered protein drinks. It needs to buy a new machine that will drain whey from processed milk. The machine costs $10 million. Tiger King anticipates that the new machine will generate additional operating cash flows of $220,000 a month for the next seven years. the company will only use this machine for seven years. At the end of seven years, Tiger King anticipates that it can sell the machine for $1 million. The company's required rate of return is 18% (discounted monthly). What is the NPV of this investment? Make sure that you note that your OCFs are per month, and when finding the present value of the cash flows you are discounting monthly (we did this using the table format). Round your answer to two decimals. If the answer is negative, include the "-" sign. If it is positive, do not include the "+" sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts