Question: QUESTION 15 6 points Save Answer Year 3 Year 4 25.00% You are interested in the valuation of the High Growth Stock. The company has

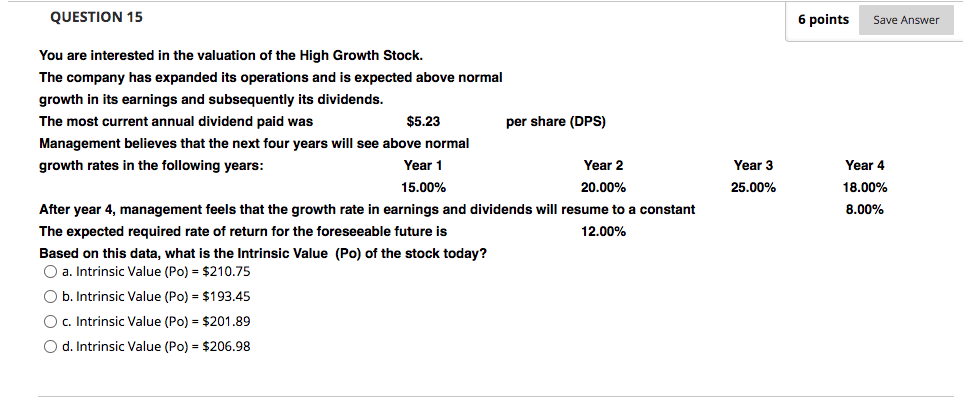

QUESTION 15 6 points Save Answer Year 3 Year 4 25.00% You are interested in the valuation of the High Growth Stock. The company has expanded its operations and is expected above normal growth in its earnings and subsequently its dividends. The most current annual dividend paid was $5.23 per share (DPS) Management believes that the next four years will see above normal growth rates in the following years: Year 1 Year 2 15.00% 20.00% After year 4, management feels that the growth rate in earnings and dividends will resume to a constant The expected required rate of return for the foreseeable future is 12.00% Based on this data, what is the intrinsic Value (Po) of the stock today? O a. Intrinsic Value (Po) - $210.75 O b. Intrinsic Value (Po) = $193.45 O c. Intrinsic Value (Po) = $201.89 O d. Intrinsic Value (Po) = $206.98 18.00% 8.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts